Compliance 2.0: Strategic implementation of AI for regulatory compliance

Navigating the maze of regulatory compliance is often daunting for many organizations. Yet, rather than just being bureaucratic hurdles, these stringent rules play a pivotal role in fortifying businesses against vulnerabilities. Functioning as a guiding beacon, they spotlight potential points of data susceptibility that could attract malicious hackers and prescribe essential measures to fortify and safeguard this data. By adhering to these regulations, organizations shield themselves from expensive data breaches and bolster data integrity and reliability.

Regulations aren’t just about safeguarding data; they also emphasize business resilience, ensuring entities can bounce back from unforeseen adversities swiftly and effectively. These rules enhance operational ethics and fortify the trust quotient with stakeholders.

While overarching federal, state, and local regulations exist, certain norms cater specifically to industries. Take the Health Insurance Portability and Accountability Act (HIPAA); it is tailored for the healthcare sector. Depending on the nature of the data they handle, organizations might be governed by different sets of regulations, making it imperative for them to discern the ones relevant to their operations.

Non-compliance isn’t just an oversight; it carries hefty financial repercussions. With regulatory bodies worldwide churning out an anticipated 300 million new regulations in the forthcoming decade, businesses must be compliant and transparent in their adherence. The intricate weave of regulations demands meticulous attention and an adaptable approach.

Yet, a shocking revelation by Corporate Compliance Insights stated that regulators imposed fines of $15B on banks in 2020, of which US banks shouldered a staggering 73%. Despite such significant financial stakes, it’s astonishing that many still hinge on outdated methods like spreadsheets and labor-intensive processes to stay compliant. With the ever-shifting regulatory landscape, manual efforts are prone to oversights.

This is where Artificial Intelligence (AI) emerges as a transformative force, offering a solution to enhance efficiency, accuracy, and adaptability in meeting the challenges of regulatory compliance. With its unparalleled prowess in efficiently processing vast swathes of regulatory data, AI is a formidable ally for organizations, demystifying regulatory intricacies and empowering businesses to act promptly, ensuring they remain on the right side of the law.

- What is regulatory compliance?

- Regulatory compliance challenges in various industries: An overview

- Why is AI for regulatory compliance an increasing need?

- Core AI technologies and their applications in regulatory compliance

- Use cases of AI for regulatory compliance

- Regulatory change management

- Regulatory data validation

- Trade surveillance

- AI testing

- Data quality management

- Regulatory analysis by supervisory authorities

- Streamlining KYC and client onboarding

- Data classification and audit trails

- Enhancing cybersecurity and regulatory compliance

- Fraud detection

- Anti money laundering efforts

- Use cases of AI in regulatory compliance across major industry verticals

- How does LeewayHertz’s generative AI platform elevate regulatory compliance processes?

- Benefits of using AI for compliance

- Implementation challenges of AI for regulatory compliance

- Best practices for deploying AI for regulatory compliance

What is regulatory compliance?

Regulatory compliance, in essence, refers to the observance of laws, guidelines, and standards set forth by governing bodies and regulatory agencies specific to an organization’s operating domain and region.

Different sectors and regions bring with them their own set of regulatory nuances. Multinational corporations, for instance, must be tuned to the diverse regulatory landscapes of all the regions they function in. Sectors like finance, IT, and healthcare encounter intricate regulations due to their extensive influence on the economy and public well-being and their heightened susceptibility to cyber threats.

As an organization scales up, it finds itself entangled in a web of regulations, which the overlapping mandates of multiple regulatory bodies may compound. This calls for establishing robust measures and frameworks to ensure steadfast compliance.

Significance of regulatory compliance

Maintaining compliance is crucial for safeguarding business credibility, championing public and stakeholder interests, and ensuring ethical operations. When a business transparently communicates its compliance strategies, it fosters trust and garners goodwill from clients and partners, enhancing brand value and potential profitability.

Regulations protect consumers from malpractices like deceptive mortgage schemes, which played a role in the 2008 financial debacle. Moreover, senior leaders of compliant businesses can evade potential legal consequences or abrupt career halts stemming from non-compliant actions.

Advantages of robust regulatory compliance

- Legal safeguarding: Regulatory frameworks act as blueprints, ensuring organizations meet all obligatory legal standards. As an illustration, by adhering to regulations such as GDPR, businesses dealing with vast user data can sidestep potential legal predicaments, making the compliance investment worth every penny.

- Workplace productivity & safety: By implementing anti-discrimination and anti-harassment guidelines, organizations can cultivate a conducive work environment, driving productivity. Additionally, strict safety protocols can avert potential mishaps and solidify organizational resilience.

- Encouraging competitive spirit: Regulations keep monopolistic tendencies at bay, fostering a competitive marketplace. This spurs innovation, motivating businesses to deliver superior offerings consistently.

- Brand fortification: An organization’s unwavering commitment to regulatory norms can enhance its public image. This commitment can be a cornerstone of branding initiatives, underscoring the company’s adherence to ethical standards.

- Risk mitigation & enhanced profitability: Persistent regulatory compliance fosters enduring customer trust. For instance, robust data protection measures can serve as a unique selling point. Furthermore, partners value and prefer collaborating with organizations perceived as reliable, leading to sustained alliances.

The repercussions of non-compliance

Neglecting regulatory norms can have grave implications. So, the intensification of regulatory and internal compliance evaluations is a key focus.

The fallout from non-compliance can be multifold:

- Financial penalties: Non-compliance can result in hefty fines, often escalating to millions. Severe transgressions, such as under GDPR, can attract penalties as steep as €20 million or 4% of the global annual turnover. In grave scenarios, top executives could face personal liabilities and even incarceration.

- Operational setbacks: Regulatory breaches can trigger legal battles, causing disruptions and further financial drain. Such breaches can expose businesses to threats like data leaks, compromise operational fluidity, and, in dire circumstances, lead to business cessation.

- Tarnished image: Violations can severely dent an organization’s reputation, leading to dwindling consumer trust and strained business relations.

- Economic impact: The aftershocks of non-compliance, including eroded customer trust and stringent post-incident regulations, can impede revenue streams and escalate operational costs for years to come.

Elevate Regulatory Compliance with Cutting-Edge AI

Regulatory compliance challenges in various industries: An overview

The complexity and extent of regulatory modifications vary across industries. Each sector has distinct regulatory requirements that organizations must follow. Collaborating with legal teams or regulatory experts is pivotal for organizations to keep abreast of changes pertinent to their industry.

Key sectors such as healthcare, financial services, and insurance have intricate regulatory landscapes that are frequently updated. This dynamism is attributed to ongoing initiatives by authorities to safeguard stakeholders, including patients, consumers, insurance holders, and investors.

Challenges in healthcare regulations

Healthcare is a sector heavily laden with regulations. This industry’s sheer volume of regulations can sometimes appear daunting, with numerous facets of healthcare being supervised by multiple regulatory entities. IT personnel and other stakeholders must stay updated about changes and new mandates for smooth operations.

- HIPAA developments and technological advancements: The rise of telehealth in 2020 prompted questions regarding patient privacy and data security. To accommodate this surge, certain HIPAA rules were temporarily eased.

- Affordable Care Act (ACA) updates: The ACA is continuously evolving. With regular updates and stringent penalties for non-compliance, organizations must stay vigilant and updated on their stipulations.

Challenges in financial industry regulations

The financial sector experiences frequent regulatory overhauls. While one can anticipate changes, predicting their exact nature is often challenging.

A couple of key regulatory focus areas for the financial industry include:

- The USA Patriot Act: This act is pivotal in bolstering measures against international money laundering and terror financing activities. Firms failing to comply risk severe penalties, potentially reaching billions.

- Financial Industry Regulatory Authority (FINRA): Established to identify and prevent financial frauds like Ponzi schemes, non-adherence to FINRA guidelines can result in penalties amounting to as much as $100 million.

Challenges in insurance industry regulations

The insurance sector is witnessing a multitude of regulatory transformations. Regional, national, and global authorities are increasingly keen on regulating various aspects of the insurance business. The implications of such oversight are vast, considering the potential bureaucratic intricacies and the assertive approach regulators seem to be taking.

A significant regulatory consideration in the insurance domain is:

- Principal-Based Reserving (PBR): Stemming from NAIC’s Solvency Modernization Initiative (SMI), PBR was introduced to better assess capital risks assumed by life insurance companies. Since its inception, insurance entities have transitioned to principle-based reserving.

Why is AI for regulatory compliance an increasing need?

In today’s fast-paced business world, regulatory compliance has become increasingly complex and challenging for entities to manage. Regulatory technology, commonly known as Regtech, is the innovative utilization of digital technology designed to simplify and even automate the compliance process. As regulations undergo continuous changes and entities are obligated to stay abreast of these updates, the significance of incorporating AI for regulatory compliance becomes more pronounced than ever before.

Challenges faced by regulators and regulated entities

Global regulatory bodies strive to maintain equilibrium in industries through laws and guidelines. Entities under these regulators must adapt to changing regulations, ensuring their practices align with set standards. Non-compliance might result in financial repercussions, damaged reputations, or even legal consequences.

Entities grapple with understanding the numerous regulations agencies impose based on their operational domain. Furthermore, documenting their compliance and being prepared for potential audits adds another layer of complexity. Simultaneously, regulatory bodies, constrained by resources, face the arduous task of monitoring a growing list of businesses to ascertain adherence to rules.

Harnessing AI for improved regulatory compliance

The introduction of AI for regulatory compliance can be transformative. Here’s how:

- Efficient interpretation of regulatory documents: Regulatory guidelines are typically lengthy, demanding significant time to understand and implement. AI-powered tools can swiftly parse these documents, extracting and presenting only the crucial aspects to compliance officers. This streamlined approach ensures swift comprehension and action without hours spent deciphering intricate regulations.

- Real-time notification of regulatory alterations: AI systems, using advanced techniques like deep learning and natural language processing, can continually scan regulator websites for changes in rules. Notifying businesses promptly about these changes ensures timely alignment with new regulatory expectations.

- Semantic web utilization: With the semantic web concept, data on the internet becomes structured and machine-readable. AI tools enable regulatory changes to be efficiently communicated and understood, ensuring businesses comply with the latest rules.

- Continuous compliance monitoring: Advanced technologies, including analytics and machine learning, empower regulators to oversee entities to adhere to rules continuously. Real-time monitoring can identify discrepancies sooner instead of sporadic, resource-heavy audits, allowing prompt corrective action. Simultaneously, businesses can leverage this information to remain compliant proactively.

- Prompt alerts and evidence collection: AI systems can instantly notify regulators of any breaches, simultaneously gathering necessary evidence for potential legal action. Such robust mechanisms can deter non-compliance, leading to a more compliant business environment.

Although regulations are essential for stable economic and social ecosystems, they shouldn’t overshadow a business’s core objectives. Integrating AI into compliance will undoubtedly provide much-needed relief for entities as regulatory burdens intensify.

Core AI technologies and their applications in regulatory compliance

Machine Learning & Deep Learning

Machine learning is a subset of AI where algorithms allow computers to learn and make decisions from data without being explicitly programmed. Deep learning, a subfield of ML, employs neural networks with many layers (hence “deep”) to analyze various data factors.

Applications in regulatory compliance:

- Anomaly detection: ML can recognize unusual patterns that don’t conform to expected behaviors. In regulatory compliance, it can be used to identify suspicious transactions in real-time.

- Trend analysis: Deep learning can be employed to understand and predict complex trends in data, helping institutions anticipate regulatory changes based on shifting industry dynamics.

- Risk management: ML models can predict potential high-risk areas or actions within an organization, ensuring early intervention.

Natural Language Processing

NLP is an AI technology that enables computers to understand, interpret, and effectively produce human language.

Applications in regulatory compliance:

- Document review: NLP enables the automated analysis of a large volume of regulatory documents, extracting key information to ensure businesses understand all compliance obligations.

- Communication surveillance: NLP can scan emails, chats, and other forms of communication to ensure they adhere to regulatory standards, flagging any inappropriate content or potential breaches.

- Regulatory reporting: By understanding the context and content, NLP can assist in generating regulatory reports, ensuring they align with the required standards.

Predictive Analytics

Predictive analytics utilizes statistical algorithms and machine learning techniques to identify the likelihood of future outcomes based on historical data.

Applications in regulatory compliance:

- Breach prediction: Predictive models can forecast potential compliance breaches, allowing organizations to rectify issues before they become significant problems.

- Operational optimization: Organizations can prepare and adapt proactively by predicting how regulatory changes might impact various operational aspects.

- Risk forecasting: Predictive analytics can give insights into future risk areas, allowing for better strategic planning and resource allocation.

Robotic Process Automation

RPA refers to software robots or “bots” that can mimic human actions to automate repetitive tasks without human intervention.

Applications in regulatory compliance:

- Routine compliance checks: RPA can routinely check compliance parameters across systems, ensuring they align with regulations without manual intervention.

- Data extraction and processing: For regulatory reporting, RPA bots can extract data from multiple sources, process it, and populate reports, ensuring speed and accuracy.

- Automated alerts: For parameters needing continuous monitoring, RPA can send instant notifications if any compliance metric exceeds the desired range.

Incorporating these AI technologies into regulatory compliance can not only improve efficiency and accuracy but can also proactively address potential risks, ensuring a more compliant and secure business environment.

Elevate Regulatory Compliance with Cutting-Edge AI

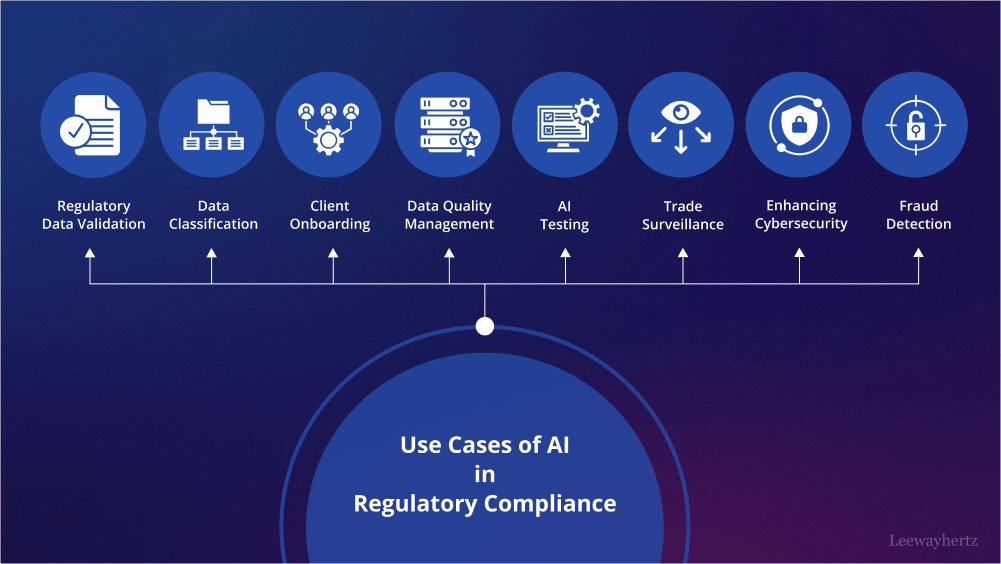

Use cases of AI for regulatory compliance

As AI deepens its roots in Regulatory Technology (RegTech), understanding and mitigating algorithmic biases, ensuring pristine data quality, and guarding against cyber threats become paramount.

Here are some potential use cases of AI for regulatory compliance:

Regulatory change management

AI plays a pivotal role in managing regulatory changes, particularly given global regulations’ vast and dynamic nature. Companies, especially those operating in multiple jurisdictions, face the daunting task of staying up-to-date with ever-evolving regulations. With AI, companies can instantly be notified about necessary adjustments to their policies and procedures as soon as a regulatory shift occurs. Not only does this streamline compliance, but by pinpointing inconsistencies between regulations, AI can also influence the creation of clearer and more harmonized regulations.

Regulatory data validation

AI can meticulously cross-check transactional data companies report, ensuring syntactically and contextual accuracy. This three-tier validation against a company’s internal systems and regulatory standards acts as an added layer of data integrity assurance.

Trade surveillance

Trade and communication surveillance often grapple with a deluge of false alarms. AI can significantly curtail these by distinguishing genuine threats from benign activities. While robotics and automation lay the groundwork, advanced AI systems evolve to outpace innovative circumvention methods.

AI testing

The efficacy of AI in regulatory settings hinges on its testability. It’s crucial to grasp the training data’s nuances and ensure the model accurately mirrors various scenarios. Any modifications to the AI model should undergo rigorous regression testing to confirm its continued efficacy.

Data quality management

Ensuring top-tier data quality is paramount. AI systems must evaluate data completeness, accuracy, and representation. They should also be adept at discerning causality in data, navigating inconsistencies across regulations, and adapting to dynamic rules. Importantly, a transparent mechanism should exhibit how AI dynamically refines its model based on real-time data.

Regulatory analysis by supervisory authorities

AI aids supervisory bodies in their oversight roles. For instance, AI tools can swiftly scour vast amounts of data, like board meeting minutes or ‘fit and proper’ assessments, to flag potential compliance issues or discern emerging risk trends.

Streamlining KYC and client onboarding

AI is significantly changing KYC (Know Your Customer) and onboarding. Beyond digital IDs, form auto-fill, and facial verification, AI can quickly analyze large data sets, offering a precise understanding of a client’s KYC profile. This rapid data processing can efficiently detect fraudulent activities.

Companies like Jumio utilize diverse datasets to ensure accurate data retrieval, which is crucial for KYC due to its high fraud risk. However, AI’s challenge lies in potential biases. Designing AI systems using diverse data is essential for accurate and fair outcomes, focusing on fairness and inclusivity.

Data classification and audit trails

Ensuring compliance requires meticulous control. Data needs to be organized based on specific criteria, and its movement and accessibility should be logged – a task that AI is aptly suited for.

AI allows organizations to automatically sort and label information, adhering to set compliance standards. For instance, when determining the proper document category from a compliance standpoint, AI systems can be quickly trained using limited samples provided by humans. This method is beneficial as humans can promptly rectify incorrect classifications during the early training stages.

Moreover, when trained with extensive data, AI can identify sensitive personal information. Once data is correctly labeled, information systems can oversee access, make edits, enforce business regulations, and maintain compliance while generating a detailed audit trail. This trail is pivotal for showcasing compliance to oversight bodies, stakeholders, and clients.

Enhancing cybersecurity and regulatory compliance

In today’s digital era, cybersecurity is paramount, and AI plays an instrumental role in fortifying defenses. One innovative use of AI is to employ generative techniques to simulate cyber threats, allowing organizations to assess and enhance their preparedness.

For instance, some companies use AI-powered tools to mimic phishing attacks. These tools send out deceptive phishing emails to employees periodically, resembling authentic phishing attempts they might encounter. Monitoring interactions with these emails, such as link clicks or sharing sensitive details, helps gauge the employees’ awareness and vulnerability levels.

Post-evaluation, each employee receives a cybersecurity score, reflecting their ability to discern and repel phishing threats. This score then guides a tailored cybersecurity training program, encompassing various educational materials ranging from webinars to interactive games, including engaging educational series akin to popular streaming content.

Such AI-enabled methods pinpoint potential vulnerabilities across all staff levels and offer insights on targeted training, ultimately bolstering the organization’s cybersecurity posture.

Fraud detection

The vast and intricate data landscape often overshadows the human capability of thorough analysis. In such scenarios, AI emerges as a pivotal solution.

Financial institutions, especially banks, grapple with multifaceted compliance responsibilities, including combating terrorism financing and halting money laundering. AI, particularly machine learning, has been instrumental since the early ’90s in detecting and preventing fraudulent activities within this realm. Leading banks today are harnessing AI’s capabilities to enhance the identification of illicit financial activities.

However, a holistic adoption of AI in these areas has faced obstacles. Concerns arise from a combination of cautionary stances and regulatory frameworks that haven’t yet evolved to embrace AI’s full spectrum. Moreover, the advent of advanced AI models, like ChatGPT, might escalate these apprehensions due to their vast capabilities.

To harness AI’s transformative potential in streamlining compliance and combatting fraud, three key aspects need to be addressed: its decision-making processes must be transparent (explainable AI), its performance should be quantifiable, and it should gain approval from regulatory bodies. AI can only truly reshape the domain with these checks, making it more efficient and robust against malicious attacks.

Anti money laundering efforts

AML represents a complex blend of financial expertise and technological acumen. With its evolving capabilities, AI is proving to be an invaluable tool in the AML arena.

Nick Henderson-Mayo, a prominent figure in compliance eLearning, highlights that AI’s strength lies in its data-processing capabilities. Advanced algorithms can sift through enormous data sets to identify unusual financial patterns or activities that might go unnoticed with traditional monitoring tools. For instance, AI is proficient at tracking customers’ transaction habits and extrapolating this data to predict future activities. It can discern even the most minute deviations in these patterns, bringing potential threats to light that might otherwise be overlooked.

While AI’s role in AML is expanding, it currently acts as a supplementary force to human expertise, enhancing the effectiveness of compliance measures rather than entirely replacing them. The interplay between human discernment and AI’s analytical prowess will define the future of AML efforts.

Use cases of AI in regulatory compliance across major industry verticals

Financial services

Regulatory change management

- Challenge: Financial institutions grapple with constant regulatory changes involving vast documents and cascading impacts. Failure to manage these changes can result in heavy fines.

- AI solution: Utilizing NLP and Intelligent Process Automation (IPA), AI can analyze, classify, and extract valuable information from regulatory documents. This keeps institutions updated and ensures compliance while preemptively avoiding fines.

Reducing false positives

- Challenge: Conventional rule-based compliance alert systems often generate high volumes of false positives, which increase operational inefficiencies and chances of human error.

- AI solution: AI and Machine Learning can fine-tune compliance alert systems by analyzing large datasets, reducing false alarms and enhancing operational efficiency.

Fraud prevention and Anti Money Laundering (AML) with anomaly detection

- Challenge: Financial institutions face the threats of ATM hacks, money laundering, lending fraud, and other cybercrimes. Traditional systems, based on fixed rules, may miss new and innovative cheating techniques.

- AI solution: AI algorithms can analyze large datasets to detect abnormal behaviors for identifying fraudulent transactions or activities. Furthermore, using graph analytics, AI can uncover patterns too subtle for human detection, providing advanced fraud protection.

Human error mitigation

- Challenge: Regulated industries suffer significant losses due to human errors arising from ineffective processes, obsolete technologies, and negligence. With growing regulatory demands, the chances for human errors in handling vast transactional and operational data are high.

- AI solution: AI and ML can minimize the impacts of human error by analyzing vast amounts of data, highlighting unseen trends, and detecting potential points of error.

The rapid evolution of the financial regulatory environment demands modern, data-driven strategies. By integrating AI, financial institutions can more efficiently tackle compliance and risk challenges, including regulatory reporting, fraud detection, and KYC processes, setting the stage for future-ready compliance teams.

Elevate Regulatory Compliance with Cutting-Edge AI

Healthcare

While AI’s potential in diagnostics and healthcare technology is recognized, its role in compliance is often underestimated. AI can prevent data breaches, ensure user safety, and guarantee compliance, making it essential for healthcare technology providers to incorporate it. AI’s preventative measures can save companies from costly non-compliance fines and foster patient trust. As patients become more interested in their rights and the treatment process, ensuring safety and reliability through AI becomes crucial.

AI and ML are becoming indispensable tools for healthcare providers to ensure compliance, enhance efficiency, and secure patient trust in an ever-evolving regulatory landscape.

Ensuring software compliance

- AI ensures the compliance of medical software providers, medical device providers, and healthcare institutions.

- AI accelerates the production of legally approved and compliant software or technology products.

Monitoring data privacy

- AI tools can help protect against cyberattacks, security breaches, and systematic non-compliance issues that could result in hefty fines.

- Specific example: AI can help prevent situations like the breach at Excellus Health Inc., which exposed the data of over 9.3 million people.

Protection and compliance with HIPAA regulations

- HIPAA focuses on ensuring the privacy and security of patient health information.

- AI and deep learning algorithms assist in protecting private data, detecting HIPAA violations, and enforcing compliance across organizations.

Updating policies

- Regulatory policies can change rapidly, and AI can assist in detecting updates in real time, allowing organizations to adapt quickly.

Data access control and management

- AI can monitor and prevent unauthorized access to patient information, addressing a major issue wherein medical workers sometimes access information they shouldn’t.

Automation and privacy analytics

- AI analyzes, anticipates challenges, and detects patterns in data to reduce risks and increase data protection.

Pharmacy and drug diversion surveillance

- AI assists in enforcing regulation standards in the pharmaceutical industry, detecting drug diversion, and monitoring transactions for increased patient safety.

Audit of pharmaceutical transactions

- AI ensures that pharmaceutical operations and transactions follow established flows and can instantly notify professionals of any deviations.

Reduce diversion incidents

- AI and algorithms learn from behavioral patterns to anticipate and reduce instances of non-compliance.

Improving patient safety

- AI ensures correct drug dosages and prescriptions, enhancing patient safety.

Pharmacovigilance

- AI is used to supervise and analyze the effectiveness of pre-approved treatments.

- AI streamlines the collection, analysis, and processing of disparate data sources, reducing the potential for human error in pharmacovigilance processes.

Manufacturing

Manufacturing has been an industry ripe for innovation and improvement, with companies consistently looking to streamline processes, reduce errors, and increase output. AI and ML have presented unparalleled opportunities to achieve these goals, especially when it comes to regulatory compliance. The provided data illuminates the applications of AI in enhancing the business value of manufacturing, and here’s how it contributes specifically to regulatory compliance:

Quality control and compliance monitoring

- Yield optimization via pattern recognition: Manufacturers often need to ensure that their products meet certain quality and safety standards. AI can assist in this through visual data analytics. For instance, AI algorithms can process vast amounts of data from visual streams and sensors to detect anomalies in manufactured goods, ensuring they comply with quality benchmarks. Hemlock Semiconductor’s utilization of AI to quickly address quality issues underscores the value of this technology in maintaining consistent product quality and, thus, staying compliant.

Maintenance and safety regulation compliance

- Predictive and prescriptive maintenance: Regulatory bodies often mandate regular equipment maintenance checks to prevent industrial accidents. AI and ML can automate the process of monitoring equipment conditions. Variations in appearance, vibration, temperature, or noise can indicate possible malfunctions. AI can predict such failures before they happen and prescribe remedial actions. Brembo’s use of AI to predict machine tools’ lifespan ensures they maintain equipment according to safety regulations, thus staying compliant.

Asset management and compliance with operational protocols

- Asset management optimization via digital twins: Digital twins offer an AI-powered virtual representation of a physical product, allowing manufacturers to test, monitor, and improve their systems in a virtual environment. This capability ensures that products are designed, assembled, and tested according to industry regulations. The prediction by IDC highlights the potential of digital twins in maintaining compliance by ensuring faster and more accurate product testing and deployment.

Competitive positioning and compliance metrics reporting

- Research from McKinsey showcases that leaders who adopt AI-infused technologies see a notable improvement in their KPIs, almost three times that of their counterparts. Regulatory bodies often demand reports showcasing adherence to standards and benchmarks. AI can aid in automatically compiling these metrics, showcasing adherence to required standards.

In essence, while AI plays a pivotal role in enhancing the business value in manufacturing by improving efficiency, reducing costs, and ensuring quality, it is equally indispensable in ensuring regulatory compliance. By automating the monitoring and reporting processes, manufacturers can ensure they always stay on the right side of regulatory guidelines, reducing the risk of penalties and ensuring safer, compliant operational processes.

Energy sector

The global energy sector is currently experiencing transformative changes, with AI playing a pivotal role in addressing challenges and ensuring regulatory compliance. Let’s break down the challenges faced by the energy sector and how AI applications ensure regulatory compliance:

Carbon emissions management and compliance

- Mitigating emissions: AI can develop cleaner production processes to help maintain emission levels within permissible regulatory limits.

- Monitoring and compliance standards for fossils: AI-enhanced monitoring ensures that fossils are utilized within regulatory standards, ensuring adherence to emission norms.

- Targeted mitigation strategies: AI can design strategies to reduce emissions, ensuring that energy companies comply with international and local emission standards.

Decentralization and grid management

- Interconnected energy grids: AI can develop smaller, interconnected energy networks, which can be more adaptable and efficient than centralized systems. This ensures regulatory adherence by avoiding the inefficiencies and vulnerabilities of a centralized grid.

Transition to renewables

- Real-time monitoring and predictions: AI contributes to accurate monitoring of power grids, ensuring that the mix of renewables and traditional energy sources complies with set regulations.

- Development strategies for geothermal energy: AI can devise methods to harness geothermal energy optimally, promoting its integration and adherence to renewable energy mandates.

Data management and security compliance

- Data digitalization: AI aids in transforming vast amounts of energy data into actionable insights, ensuring that energy operations are efficient and within regulatory norms. It also ensures that the digitization process maintains cybersecurity standards, as highlighted by Deloitte.

Forecasting and resource allocation

- Smart forecasting: AI-backed deep learning algorithms can predict energy demands, price trends, and potential growth areas. This ensures efficient resource allocation, minimizing wastage, and ensuring energy providers comply with efficiency mandates.

- Resource management: AI ensures that both traditional and renewable energy sources are used optimally, meeting energy standards and regulations.

Operational safety and prevention

- Failure prevention: AI can preemptively detect potential failures in the energy sector. This proactive approach ensures that energy operations remain safe, avoiding incidents like oil spills, which can lead to regulatory penalties.

- Predictive analytics for renewables: AI identifies optimal areas for renewable energy development, ensuring that energy generation from these sources is maximized and complies with renewable energy mandates.

Innovation and integration

- Smart grid: AI empowers the development of self-regulating grids that offer better forecasting, resilience, and security. This ensures that energy distribution is efficient, reducing wastage and complying with efficiency standards.

- Energy-efficiency programs: AI-driven programs regulate energy usage, especially during peak hours, ensuring energy consumption remains efficient and within regulatory limits.

- Digital twins: In the energy sector, digital twins can simulate real-world scenarios, aiding in better servicing and maintenance. This ensures that energy infrastructure remains optimal and compliant with safety and efficiency regulations.

- Renewable energy integration: AI aids in seamlessly integrating renewable energy sources into the traditional grid. This ensures a balanced energy mix, adhering to renewable energy mandates.

AI plays a vital role in ensuring that the energy sector remains compliant with various regulatory standards, from emission norms to safety regulations. By harnessing the power of AI, the energy sector can not only improve efficiency and reduce costs but also ensure that operations remain within the bounds of international and local regulations.

Elevate Regulatory Compliance with Cutting-Edge AI

How does LeewayHertz’s generative AI platform elevate regulatory compliance processes?

LeewayHertz’s generative AI platform, ZBrain, plays a transformative role in enhancing regulatory compliance operations, enabling effective navigation of intricate regulatory scenarios and ensuring adherence to stringent standards for enhanced risk management. As a comprehensive, enterprise-ready platform, ZBrain empowers businesses to design and implement applications tailored to their specific operational requirements. The platform uses clients’ data, whether in the form of text, images, or documents, to train advanced LLMs like GPT-4, Vicuna, Llama 2, or GPT-NeoX for developing contextually aware applications capable of performing diverse tasks.

Enterprises grapple with challenges in regulatory compliance, including navigating complex and evolving regulatory frameworks, ensuring timely updates, managing the escalating volume of regulatory requirements, addressing jurisdictional variations, mitigating cybersecurity risks, and maintaining alignment with industry best practices. ZBrain effectively addresses these challenges through its distinctive feature called “Flow,” which provides an intuitive interface that allows users to create intricate business logic for their apps without the need for coding. Flow’s easy-to-use drag-and-drop interface enables the seamless integration of large language models, prompt templates, and other generative AI models into your app’s logic for its easy conceptualization, creation, or modification.

To comprehensively understand how ZBrain Flow works, explore this resource that outlines a range of industry-specific Flow processes. This compilation highlights ZBrain’s adaptability and resilience, showcasing how the platform effectively meets the diverse needs of various industries, ensuring enterprises stay ahead in today’s rapidly evolving business landscape.

ZBrain’s potent applications optimize regulatory compliance processes, converting intricate data into actionable insights for enhanced efficiency, improved accuracy, and real-time monitoring, fostering adaptive compliance to address evolving requirements swiftly. ZBrain’s comprehensive solutions adeptly tackle key challenges in regulatory compliance processes. Explore the following section, highlighting how ZBrain ensures a seamless approach to regulatory compliance in the finance and banking sectors.

AI-driven financial regulatory compliance

ZBrain presents an advanced solution for simplifying and streamlining regulatory compliance tasks in finance and banking. It consolidates diverse data relevant to financial regulatory compliance, including the latest amendments, internal compliance information, policy documents, and audit reports. Conducting automated Exploratory Data Analysis (EDA) on this dataset, ZBrain evaluates the organization’s compliance status and identifies potential areas of concern. Utilizing sophisticated techniques, ZBrain converts textual data into numerical embeddings, capturing intricate data relationships for efficient retrieval and analysis. These embeddings serve as the basis for in-depth analysis, enhancing ZBrain’s ability to detect regulatory irregularities and provide accurate compliance recommendations. Upon user request, ZBrain assesses the organization’s compliance status using the chosen Language Model (LLM) to generate a detailed report outlining deviations and recommended actions. Leveraging these embeddings, the LLM offers profound insights, highlighting areas of attention and suggesting actionable steps for adherence. Following the LLM-generated compliance report, ZBrain employs a rigorous parsing technique to fine-tune the report, delivering only pertinent insights. This meticulous approach ensures compliance officers receive precise, actionable, and timely recommendations, reinforcing ZBrain’s commitment to facilitating effective regulatory compliance.

ZBrain applications empower financial institutions by optimizing operational efficiency through streamlined automation, ensuring precision in processing large data volumes, reducing costs, providing actionable insights, facilitating timely reporting, mitigating compliance risks, and enabling continuous monitoring, all while upholding strict data privacy standards. Delve into this comprehensive Flow to understand how ZBrain optimizes regulatory compliance in finance, offering a more accurate and efficient approach to navigating complex regulations and optimizing decision-making processes to maintain meticulous compliance records.

Benefits of using AI for compliance

AI has rapidly transformed the regulatory compliance landscape across various sectors. Its ability to capture, process, and analyze vast amounts of data at unmatched speeds has provided several significant benefits to industry compliance programs worldwide. Let’s explore the advantages of AI in ensuring effective and efficient regulatory compliance:

Reduced false positives

- A high frequency of false positives has plagued traditional compliance systems in major banks. Such alerts necessitate human intervention, leading to inefficiencies and potential oversights.

- AI and ML technologies can refine alert systems by analyzing various data elements, thus drastically reducing false alarms. As these technologies adapt and learn from the data, they can optimize compliance alerts to nearly perfect levels.

Cost efficiency

- The increasing digitalization of the financial sector and the subsequent regulatory requirements have ushered in the era of big data. AI and ML can process and analyze this data more efficiently than manual systems.

- By automating workflows, AI reduces the need for extensive human capital in compliance operations. Combined with AI systems’ heightened accuracy, these automated workflows can result in massive annual savings for institutions.

Minimizing human error

- With regulations becoming more intricate, compliance officers manage vast amounts of data, increasing the chances of human errors.

- AI and ML can act as checks against these errors, much like calculators verifying manual calculations. They can identify patterns and trends that human analysts might overlook. Moreover, these systems can point out inconsistencies, reducing costly mistakes.

Enhanced governance

- AI, like GPT-3, can sift through countless sources to collate regulatory updates, offering concise summaries for managerial review. When changes warrant updates to firm procedures, AI can draft initial policy documents based on specific inputs. By leveraging AI for governance, institutions can expedite change management, reduce costs, and ensure updated compliance processes.

Streamlined SAR writing

- SARs, crucial to BSA/AML compliance programs, require a detailed investigation and subsequent reporting of suspicious activities. With AI, the process can be accelerated significantly. AI can identify suspicious activities, determine risk typologies, perform extensive searches to form a detailed customer profile and draft a comprehensive SAR. Investigators can review AI-generated drafts instead of manually crafting these reports, ensuring speed and accuracy.

Revamped ongoing monitoring

- AI can redefine the logic that supports screening and monitoring tools. By leveraging additional data sources, AI can create comprehensive customer profiles that accurately define suspicious activities. This transition can help reduce false alerts, identify compliance risks, and foster more dynamic, ongoing due diligence models.

AI’s integration into regulatory compliance represents a paradigm shift, offering a more efficient, accurate, and cost-effective approach to ensuring industry compliance. Its adaptive nature, combined with its unmatched processing power, positions AI as an invaluable asset in the ever-evolving world of regulatory compliance.

Implementation challenges of AI for regulatory compliance

Bias and discrimination

- The nature of AI is inherently influenced by its creators. Consequently, AI algorithms can also reflect these prejudices if designed by individuals with latent biases.

- If not critically assessed, historical data can perpetuate existing AI biases. An example is Amazon’s recruitment AI, which displayed a preference for male resumes due to the male-dominated hiring data from the previous decade.

- Biased AI can jeopardize an organization’s compliance stature and harm its reputation and profitability. Hence, it’s paramount to ensure AI systems function ethically and impartially.

Data privacy

- AI’s efficacy hinges on the continuous ingestion of large data sets. However, this data-centric nature poses significant data privacy concerns.

- Complying with data privacy regulations becomes crucial as businesses collect and input vast amounts of customer and employee information into AI systems.

- Beyond just compliance, safeguarding this data from potential breaches is imperative. It requires robust security measures and awareness programs to ensure the integrity of sensitive information.

Security vulnerabilities

- AI’s advanced capabilities, while offering myriad advantages, also present opportunities for misuse and criminal activities.

- As AI technologies become deeply embedded in organizational processes, ensuring they adhere to company policies and values is essential. Continuous security training and vigilant system monitoring can assist in mitigating potential threats.

Antitrust implications

- The power of AI lies in its capacity to analyze and make decisions that can radically transform market dynamics. However, unchecked or unethical use of AI can lead to anti-competitive practices.

- A scenario where a corporation uses AI to collude on pricing can decimate competition, leading to market monopolization and the ousting of smaller competitors.

- The potential misuse of AI has grabbed the attention of regulators, making it vital for businesses to be conscious of potential antitrust violations. AI should be harnessed to enhance organizational efficiency rather than flout competition regulations.

As the prominence of AI in compliance continues to grow, organizations need to address these challenges preemptively. By doing so, they can ensure that AI not only optimizes their processes but also upholds their operations’ integrity and ethical standards.

Best practices for deploying AI for regulatory compliance

In an age where AI is upgrading industries, deploying AI for regulatory compliance is both promising and challenging. Adopting best practices can help organizations realize the benefits of AI in compliance without falling foul of regulatory requirements:

Adopt a holistic view of AI compliance

- Regulatory requirements vary across jurisdictions and evolve continuously. Implementing AI can inadvertently affect compliance with existing rules.

- Instead of a piecemeal approach, adopt a holistic strategy for AI compliance, ensuring consistent procedures and leveraging controls across the organization. This global perspective helps in balancing AI innovations with diverse regulatory demands.

Stay updated with the AI compliance landscape

- The rapid development of AI means that regulatory frameworks are frequently updated or newly instituted.

- Proactively monitor and understand these changes to anticipate potential impacts on your organization’s compliance posture. Being proactive minimizes disruptive last-minute adjustments.

Map AI compliance requirements

- Compliance requirements differ based on jurisdiction and the specific AI application in use.

- Invest in mapping tools or services, like IBM Promontory Services, to pinpoint requirements. This approach helps prioritize tasks, understand overlapping areas, and ensure full compliance across multiple jurisdictions.

Invest in training and process enablement

- Regulatory compliance in the AI domain is not just a technical challenge but also a human one.

- Invest in training programs that empower employees to understand AI compliance objectives, their role in achieving those, and the practical steps involved. A well-informed team can act as the first line of defense against inadvertent compliance breaches.

Promote a positive AI compliance culture

- While monitoring and enforcement are critical, fostering a positive compliance culture is equally vital.

- Focus on building trust and transparency, emphasizing the value of AI compliance rather than merely its requirements. A cooperative and informed workforce is more likely to champion compliance, smoothing the organization’s journey.

Implement robust data management practices

- Given the data-driven nature of AI, ensuring data privacy, security, and ethical usage is paramount.

- Establish clear data governance protocols, regularly audit AI models for biases, and ensure data sources are trustworthy and ethically sourced.

Engage with regulators and industry groups

- Actively participate in discussions with regulatory bodies and industry groups. This engagement can provide insights into upcoming changes and best practices.

- Collaborative efforts can help shape AI regulatory frameworks that are both innovative and protect societal interests.

While AI presents numerous opportunities to streamline and enhance regulatory compliance, it comes with challenges. By embracing these best practices, organizations can harness AI’s potential responsibly and effectively.

Endnote

Compliance remains a steadfast pillar in the rapidly evolving business and technology landscape, ensuring integrity, accountability, and trust. As the nexus of AI and compliance strengthens, it unveils transformative potential— AI, underpinned by natural language processing, brings forth game-changing capabilities like real-time risk assessment and meticulous monitoring. These advancements promise to empower compliance professionals with tools that enhance accuracy and streamline operations. Yet, with great power comes great responsibility. It’s not enough to merely embrace these technologies; they demand rigorous scrutiny to uphold their fidelity to regulatory standards. As we chart this untraveled territory, the ultimate goal remains clear: harnessing AI’s prowess while staying firmly anchored to the foundational principles of legality, ethics, and transparency. The future of compliance is not just about adaptation but about evolving with both precision and purpose.

Ready to elevate your compliance journey? Dive into the future with LeewayHertz’s AI-driven regulatory compliance solutions. Act now and ensure your business remains steps ahead of the curve.

Start a conversation by filling the form

All information will be kept confidential.

FAQs

Why is AI becoming increasingly important for regulatory compliance?

What are the main challenges faced by regulators and regulated entities in maintaining compliance?

How does AI improve the interpretation of regulatory documents?

What role do Machine Learning and Deep Learning play in regulatory compliance?

How does Natural Language Processing (NLP) contribute to regulatory compliance?

What are some use cases of AI for regulatory compliance in major industry verticals?

What benefits does AI bring to regulatory compliance?

AI reduces false positives, improves cost efficiency, minimizes human errors, enhances governance, streamlines Suspicious Activity Report (SAR) writing, and revamps ongoing monitoring. Its integration ensures a more efficient, accurate, and cost-effective approach to regulatory compliance.

What are the best practices for deploying AI for regulatory compliance?

Best practices include adopting a holistic view of AI compliance, staying updated with the AI compliance landscape, mapping AI compliance requirements, investing in training and process enablement, promoting a positive AI compliance culture, implementing robust data management practices, and engaging with regulators and industry groups.

How can organizations ensure responsible use of AI in regulatory compliance?

To ensure responsible use, organizations should continuously assess and mitigate biases, prioritize data privacy, address security vulnerabilities, avoid antitrust implications, and actively engage with regulators and industry stakeholders. A transparent and ethical approach is essential for the responsible deployment of AI in regulatory compliance.