Insurance

AI-powered Insurance Claims: Redefining Processing Speed and Accuracy

Time-consuming and Error-prone Insurance Claim Processes

Efficient and accurate insurance claim processing is vital in the finance and banking industry. It impacts customer satisfaction, operational costs, and regulatory compliance. However, this task is often hindered by complexity and vast amounts of data, making it time-consuming and prone to errors. ZBrain provides a solution by simplifying and automating insurance claim processing.

I. How ZBrain Flow Enhances Insurance Claim Processing

Leveraging the power of artificial intelligence and machine learning, ZBrain automates the traditionally manual insurance claim processing procedure. Here’s a comparison of the time required for each task with and without ZBrain Flow:

| Steps | Without ZBrain Flow | Time Without ZBrain Flow | With ZBrain Flow |

|---|---|---|---|

| Data collection and preprocessing | Manual | ~10 hours | Automated by ZBrain Flow |

| Claim assessment | Manual | ~12 hours | Automated by ZBrain Flow |

| Report generation | Manual | ~5 hours | Automated by ZBrain Flow |

| Claim approval | Manual | ~3 hours | Manual |

| Total | ~30 hours | ~4 hours |

The data in the table clearly illustrates that ZBrain drastically diminishes the duration of insurance claim processing, reducing it from roughly 30 hours to a mere 4 hours. This transformative decrease translates to significant savings in both time and costs.

II. Key Input Data

For ZBrain to optimize insurance claim processing and produce accurate results, it relies on the following data sources:

| Information Source | Description | Recency |

|---|---|---|

| Customer records and policies | Client-specific insurance policies and claims history | Always updated |

| External data sources (e.g., weather, accident reports) | External data impacting insurance claims, such as weather conditions and accident reports | Real-time or historical |

| Medical records and reports | Medical data relevant to health insurance claims | Last 1 year |

| Policyholder information | Data on the insured parties, including personal and contact details | Always updated |

| Government and regulatory data (e.g., DMV, IRS) | Data related to government regulations and taxation affecting insurance claims | Current and last fiscal year |

III. ZBrain Flow: How It Works?

Step 1: Data Collection and Exploratory Data Analysis

ZBrain initiates the insurance claim processing by automatically collecting the relevant data such as customer records, external data sources, medical records, policyholder information, and government data, ensuring that all information is accurate and up to date. Once the data is validated, ZBrain performs an automated EDA, revealing helpful insights within the gathered data. This step is pivotal in identifying patterns, anomalies, and historical trends that can greatly enhance the overall efficiency of the insurance claim processing procedure.

Step 2: Embeddings Generation

In this stage, textual data is converted into numerical embeddings using advanced techniques. These embeddings capture the semantic relationships within the data, enabling ZBrain to retrieve and analyze information efficiently. The generated embeddings simplify claim information assessment against policy terms and conditions, medical records, and external data to determine claim validity and calculate settlement amounts.

Step 3: Query Execution and Report Generation

Once a claim is prepared for processing, ZBrain utilizes the OpenAI Language Model (LLM) to evaluate the insurance claim status. A detailed report is promptly generated in response to the user’s query, providing essential information about the claim, its assessment, and the proposed settlement. The report generation process is characterized by its high efficiency and consistency, guaranteeing the inclusion of all pertinent information.

Furthermore, with the help of embeddings, the OpenAI LLM is capable of offering deep insights, conducting a thorough review to detect any potential signs of fraud, and providing actionable recommendations for the claim.

Step 4: Parsing and Final Output Generation

After the report is generated by the LLM, ZBrain employs a parsing technique to refine the report and extract useful insights. ZBrain’s role in this phase involves delivering comprehensive, well-organized data that ultimately speeds up the approval process and reduces the time needed for claim settlement.

Streamlined Insurance Claim Processing

ZBrain transforms insurance claim processing in the finance and banking industry, significantly reducing the time and effort needed for this critical task. Traditional claim processing, taking around 30 hours, is simplified to approximately 3 hours with the help of ZBrain. This efficiency results in cost savings and improved customer service, empowering finance and banking institutions to make better decisions and maintain regulatory compliance. Experience the benefits of ZBrain to optimize insurance claim processing and enhance your organization’s success.

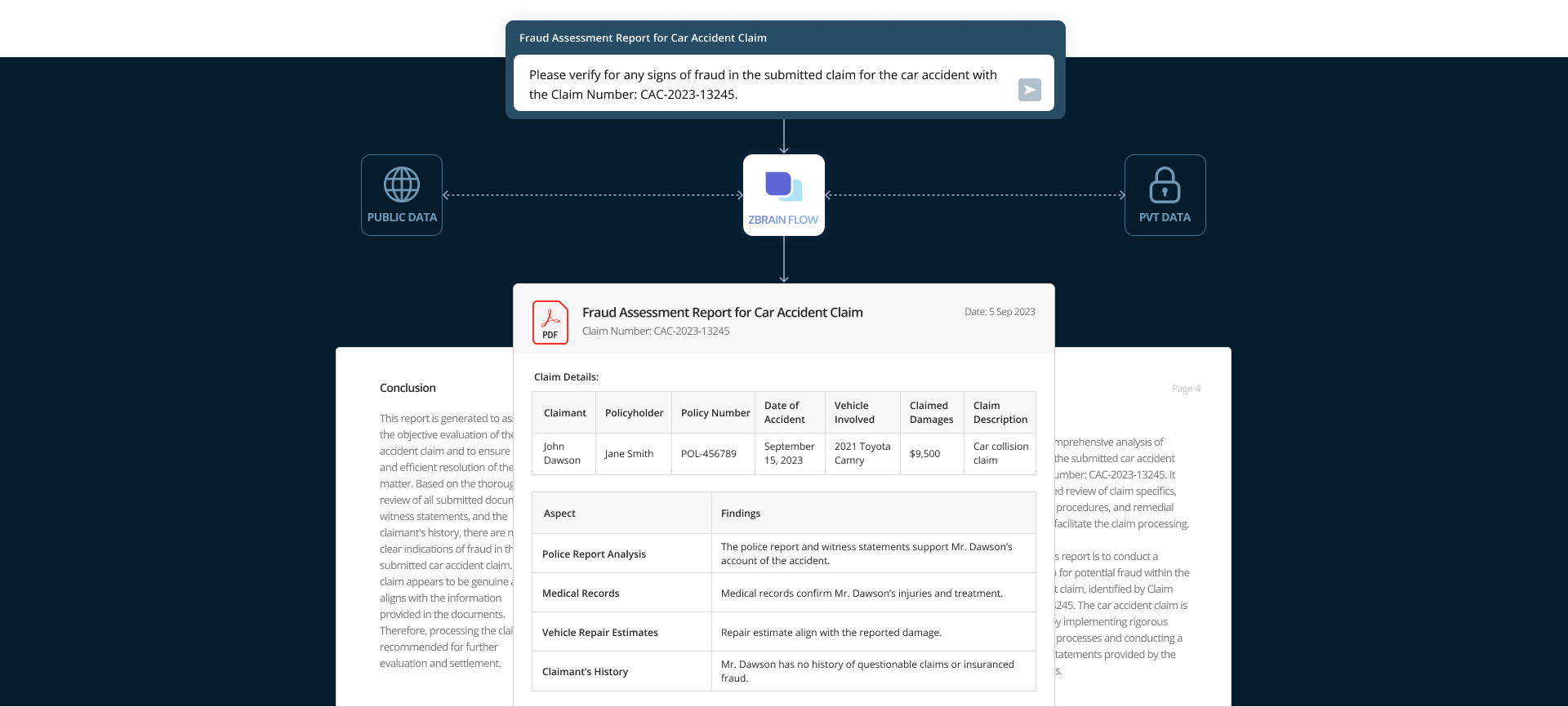

Prompt:

Please verify for any signs of fraud in the submitted claim for the car accident with the Claim Number: CAC-2023-13245.

Executive Summary

This report offers a comprehensive analysis of potential fraud within the submitted car accident claim bearing Claim Number: CAC-2023-13245. It encompasses a detailed review of claim specifics, document verification procedures, and remedial actions to be taken to facilitate the claim processing.

Introduction

The primary aim of this report is to conduct a thorough investigation for potential fraud within the submitted car accident claim, identified by Claim Number: CAC-2023-13245. The car accident claim is assessed thoroughly by implementing rigorous document verification processes and conducting a meticulous review of statements provided by the claimant and witnesses.

Claim Details

| Claimant | Policyholder | Policy Number | Date of Accident | Vehicle Involved | Claimed Damages | Claim Description |

|---|---|---|---|---|---|---|

| John Dawson | Jane Smith | POL-475968 | October 31, 2023 | 2021 Toyota Camry | $9,500 | Car collision claim |

Claim Description

The claimant, Mr. John Dawson, has filed a car accident claim under policy number POL-475968 for damages incurred in a vehicular collision on October 31, 2023. The claim covers vehicle repairs and medical expenses.

Document Verification

All necessary documents have been submitted, including:

| Document | Status |

|---|---|

| Police report | Submitted |

| Repair estimates | Submitted |

| Medical reports | Submitted |

| Witness statements | Submitted |

| Photographs of the accident scene | Submitted |

| Vehicle registration and insurance information | Submitted |

Claim Review Findings

The submitted car accident claim has undergone a comprehensive review to assess any indications of fraud. The review includes an analysis of the provided documents, witness statements, and the claimant’s history. Below are the findings:

- Police Report Analysis:

-

The police report (Document ID: CAC-PR-2023-6875) indicates that the accident occurred at the reported location and time.

-

Witness statements confirm Mr. Dawson’s account of the accident.

- Medical Records:

-

Medical records (Document ID: CAC-MR-2023-1324) assure that Mr. Dawson received treatment for the reported injuries, including a fractured arm and minor whiplash.

-

The medical provider, Regional Hospital, has verified the treatments nursed.

3. Vehicle Repair Estimates:

- Vehicle repair estimates (Document ID: CAC-VE-2023-9876) have been obtained from two reputable auto repair shops.

-

Both estimates align with the extent of damage reported in the claim.

- Claimant’s History:

-

Mr. Dawson has no prior record of filing questionable or fraudulent claims.

-

There are no indications of a history of insurance fraud associated with the claimant.

Recommended Next Steps

-

Proceed with the standard claim processing procedure, including the assessment of repair costs and medical expenses.

-

Notify Mr. Dawson of the claim’s acceptance and the expected timeline for settlement.

Conclusion

This report is generated to assist in the objective evaluation of the car accident claim and to ensure a

fair and efficient resolution of the matter. Based on the thorough review of all submitted documents, witness statements, and the claimant’s history, there are no clear indications of fraud in the submitted car accident claim. The claim appears to be genuine and aligns with the information provided in the documents. Therefore, processing the claim is recommended for further evaluation and settlement.