AI use cases and applications in private equity & principal investment

Private equity investors traditionally relied on personal networks for deal flow, acting more as farmers than hunters. However, technological advancements, particularly private equity artificial intelligence, enable investors to hunt for new opportunities proactively. Amid increasing competition for quality assets, record levels of dry powder, and soaring valuations, the best investors are becoming the best hunters.

As competition intensifies among private equity firms, they are seeking innovative approaches to identify investment opportunities. This includes leveraging AI-driven algorithms to scour diverse channels for specific criteria, effectively creating a repository of potential businesses ideal for equity funding.

As the world’s data volume is expected to reach 163 zettabytes by 2025, with 80% being unstructured, investors harnessing even a fraction of this data will gain deep, actionable insights for highly informed investment decisions.

Some investors are exploring data mining to map performance, market sentiment, and trends and identify businesses ready for equity investment. Monitoring domain authority, web traffic, social media activity, app downloads, and media footprint could indicate traction. AI algorithms can establish correlations and patterns, intelligently filtering through massive structured and unstructured data to rank companies. Advancements in machine learning make these algorithms increasingly efficient and capable of processing more data.

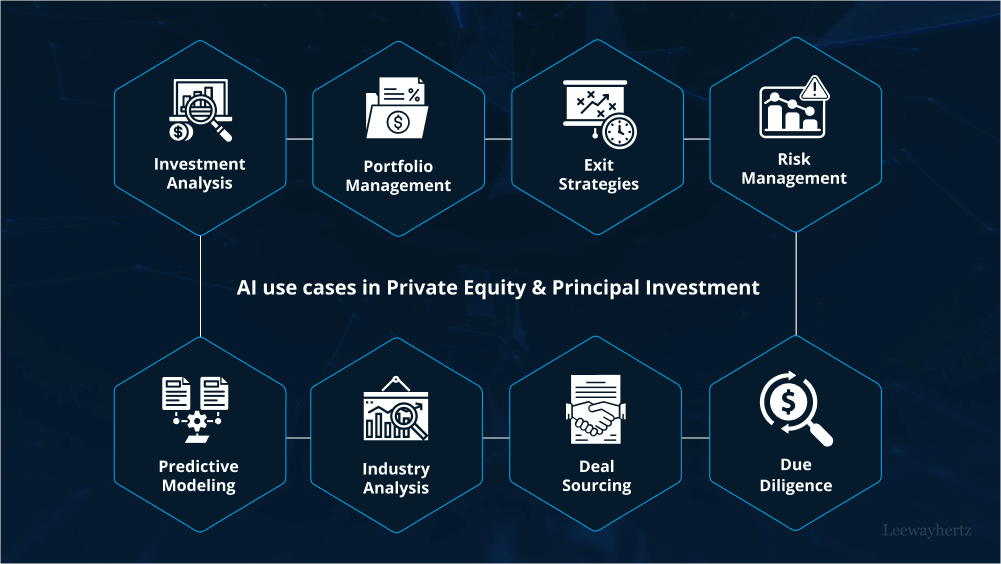

In this article, we will delve into the myriad applications of AI within both private equity and principal investment realms. We will shed light on how AI is transforming investment screening and analysis, streamlining due diligence processes, enhancing portfolio management, and optimizing exit strategies. Additionally, we will explore the transformative impact of AI in private equity which includes deal sourcing, industry analysis, and the formulation of strategic deal structures in principal investment firms.

- The impact of AI on private equity & principal investment

- AI use cases and applications in private equity & principal investment

- How LeewayHertz’s generative AI solution transforms private equity and principal investment

- How to incorporate AI solutions into private equity and principal investment businesses?

- How is AI used for lead generation in private equity & principal investment firms?

- How does AI aid in intelligent investment decision-making?

- Improving private equity and principal investment strategies with AI agents

- AI in private equity & principal investment firms: The benefits

- Future trends of AI in private equity & principal investment

The impact of AI on private equity & principal investment

AI is having a transformative impact on the private equity and principal investment industries. The ability to process vast amounts of data quickly and accurately enables firms to enhance their decision-making processes, streamline operations, and achieve better investment outcomes.

-

Automating investment screening and due diligence: AI is significantly automating the investment screening process in private equity. It conducts comprehensive due diligence by sifting through large volumes of data, including financial statements, market research, and other relevant documents, making the process more efficient and accurate. In principal investment, AI helps in sourcing deals, conducting thorough industry analysis, and developing optimal deal structures.

-

Data analysis and predictive modeling: Investors are using AI in private equity and investment to analyze financial and non-financial data, identify patterns, and generate predictive models to inform their investment decisions. By leveraging AI, firms can process large volumes of unstructured data effectively, gaining valuable insights to support their investment decisions.

-

Optimizing exit strategies: AI also plays a crucial role in optimizing exit strategies by identifying the right timing and exit route for investments. AI’s ability to analyze market trends and insights enables firms to make well-informed decisions regarding their exits.

-

Lead generation and personalization: AI is being utilized for lead generation by private equity firms. By analyzing data from sources like LinkedIn and company websites, AI can draft tailored emails that demonstrate knowledge and interest in the target companies. This level of personalization can increase the likelihood of successful engagement with potential investment targets.

-

Improving operations in portfolio companies: Portfolio companies, which are often advanced in technology adoption, are using AI to improve their operations. While private equity firms are currently addressing their internal AI needs, they are expected to push AI adoption across their portfolio companies in the future.

-

Overcoming challenges in AI adoption: The biggest hurdle for private equity firms in AI adoption is protecting proprietary data behind firewalls. To address this issue, the industry is exploring solutions such as risk governance and synthetic data generation for more secure implementation of AI tools.

-

Growing interest and proof of concept projects: With the availability of large language models to the public, there is growing interest in AI within private equity firms. Many firms are seriously evaluating AI and working on proof of concept projects to test the technology’s potential in enhancing their operations and investment outcomes.

AI use cases and applications in private equity & principal investment

Artificial intelligence has been transforming private equity and principal investment firms’ operations. Here are some key AI use cases and applications for AI private equity and investment:

Investment screening and analysis

Investment screening and analysis in private equity, a complex process traditionally carried out by experienced professionals, can be transformed with AI. AI-powered tools can automate the data aggregation phase by pulling information from diverse sources, such as financial statements, news articles, and industry reports, into a unified, structured format.

Once the data is compiled, machine learning algorithms can identify patterns that may signify an attractive investment opportunity, such as consistent revenue growth and low debt levels. AI also plays a crucial role in predictive analytics, leveraging historical data to forecast a company’s future financial performance or industry trends. Furthermore, AI can assess the risks associated with potential investments by analyzing indicators like declining sales or increasing debt levels, which could signal financial distress.

AI supports private equity firms during the due diligence process by automating tasks like data extraction, review, and analysis. Natural language processing algorithms can sift through legal and financial documents, extracting essential information for a structured presentation, streamlining the process and reducing error risks. In the valuation analysis stage, machine learning can evaluate financial data and industry trends to estimate a potential investment target’s fair value, aiding private equity firms in making informed price decisions.

Finally, AI-powered tools can execute scenario analysis to determine how varying factors, such as interest rates or economic growth, could impact a potential investment’s performance. AI can enhance private equity investment screening and analysis processes by automating tasks, spotting patterns, supporting due diligence and valuation, and facilitating more informed decision-making.

Due diligence

The process of identifying and evaluating potential investments in privately held companies can be both intricate and time-intensive. Private equity firms must conduct an exhaustive due diligence process each time they assess the risks and potential returns associated with a possible investment. This process usually entails the analysis of various data, including financial statements, market trends, and the target company’s performance.

AI technology can significantly enhance the due diligence process in private equity. With the aid of machine learning algorithms and natural language processing, AI systems can process vast amounts of data and discern trends and patterns that might be difficult for human analysts to identify.

An AI-powered tool can consolidate different types of information, such as the average basket price in a retail store or the typical user of a SaaS product under consideration. This tool can present the data in an easily digestible format, eliminating the need for manual sorting and processing. As a result, private equity firms can save time and resources and more readily recognize patterns, trends, and opportunities for growth and improvement.

A case in point is Kira, a Canadian company that employs AI to convert raw data, such as legal or financial documents, into a comprehensive dashboard that offers a well-rounded view of a company. Kira automates tasks like data extraction, review, and analysis, enabling users to gain insights more effectively.

International law firm Shearman & Sterling exemplifies how major firms can leverage AI for due diligence. Rather than manually proofreading contracts, the firm employs artificial intelligence to sift through contracts for insights and organize the information. This approach illustrates how AI can help firms make more informed investment decisions and potentially mitigate the risk of non-profitable investments. It is particularly advantageous in the due diligence process, as the technology allows for more data to be analyzed in a shorter timeframe, thereby enhancing efficiency.

Portfolio management

AI has applications beyond due diligence in the investment sector, notably in portfolio management. Private equity firms handle multiple portfolios, and scrutinizing the performance of each portfolio is a vital but challenging task. AI can be utilized to monitor Key Performance Indicators (KPIs) and detect trends and patterns that may signal a need for intervention.

An AI system, for instance, could be programmed to analyze financial data from a portfolio company and alert the private equity firm to worrisome trends, such as falling sales or rising expenses. It can also help predict how a pandemic might impact an industry by analyzing how a previous pandemic, like COVID-19, affected the sector under similar circumstances. This enables the firm to take prompt actions to address potential issues and enhance the company’s performance.

AI’s automation and continuous learning abilities in due diligence are other notable benefits. With AI, tasks can be automated, and the algorithms keep learning with each application, increasing their accuracy over time. As a result, they become increasingly effective with each use, allowing you to gain more precise and reliable insights more quickly.

AI’s application in portfolio management can also assist private equity firms in making better-informed decisions regarding resource allocation and optimizing the performance of their portfolio companies. For instance, an AI system could be employed to analyze data from multiple portfolios and identify which companies are performing well and which require additional support. This can help private equity firms make more efficient use of their resources and maximize their investment returns. In summary, the application of AI in portfolio management has the potential to enhance risk management and decision-making in the private equity industry.

Exit strategies

AI is essential in crafting exit strategies for private equity investments, offering valuable insights and automation capabilities. AI can help private equity firms assess the optimal time to exit an investment, as it can process vast amounts of data to identify trends and patterns that signal an attractive selling opportunity. By analyzing market conditions, industry trends, and competitive landscapes, AI can help determine the best exit strategy – whether that be through an initial public offering, a merger or acquisition, or a secondary buyout.

AI can also play a vital role in assessing the value of the portfolio company prior to the exit. AI-powered valuation tools can consider various factors, including financial data, industry trends, and market conditions, to provide a more accurate valuation that reflects the company’s true worth. AI can also help manage the due diligence process during an exit, quickly analyzing the vast amounts of data involved and identifying potential risks or discrepancies that could impact the transaction.

Additionally, AI can assist in negotiation processes by providing insights into market trends and competitor transactions, ensuring that the private equity firm secures the best possible terms in the exit deal. By streamlining the exit strategy process, AI can help private equity firms maximize the return on their investments and reduce the time and resources required for successful exits.

Risk management

AI for private equity and principal investment plays a crucial role in risk management within the private equity sector. By employing AI tools, private equity firms can systematically analyze vast volumes of data to uncover and assess risks associated with potential investments and the broader portfolio. AI can analyze financial data, market trends, industry insights, geopolitical events, and regulatory changes to identify potential risks and offer predictive insights into how these factors might affect portfolio companies.

For instance, AI can identify correlations between market events and the performance of specific companies, enabling private equity firms to take preventative measures before market downturns occur. AI can also model various risk scenarios, allowing firms to develop contingency plans based on the potential impact of different risks. Furthermore, AI can enhance due diligence processes by analyzing potential investments for red flags, such as irregularities in financial statements or negative news coverage, helping firms avoid risky investments.

By continuously monitoring these data points, AI provides real-time risk assessments, enabling private equity firms to respond quickly to emerging threats or capitalize on opportunities. In summary, AI’s ability to process and analyze vast amounts of information makes it an invaluable tool for managing risk in the private equity sector, helping firms make informed investment decisions, protect their existing portfolios, and optimize returns.

Deal sourcing

AI has emerged as a powerful tool for private equity firms seeking to identify and evaluate potential investment opportunities. With an ever-growing number of companies to consider for investment, the process of discovering and assessing these prospects can be both time-consuming and resource-intensive.

By deploying AI, private equity firms can uncover potential investment opportunities that might otherwise elude human analysts. For example, AI systems equipped to scrutinize financial data can help identify companies that are undervalued or poised for growth. Such systems can aid firms in discovering and evaluating new investment opportunities with greater precision and efficiency.

Moreover, AI can offer invaluable support during the negotiation phase. AI systems capable of analyzing market trends can provide valuable insights, helping private equity firms determine the most favorable price to offer for a potential investment.

In short, employing AI for deal sourcing can enhance both the speed and accuracy of the investment process in the private equity sector. A 2020 report from Cerulli Associates revealed that hedge funds with AI capabilities enjoyed a distinct competitive edge over their counterparts.

Firms like Pilot Growth, EQT, and Jolt Capital have also developed proprietary AI-powered deal-sourcing tools to pinpoint and assess early-stage opportunities. Alternatively, for private equity firms that prefer to concentrate their time and resources on core business development strategies rather than software development, AI-powered platforms available via subscription offer a viable alternative. Platforms such as Udu provide a suitable substitute for those not interested in crafting an in-house solution.

Investment research

AI-powered investment research solutions, originally developed for public market investors, are now being adopted by the private equity industry. An example of this is AlphaSense, an AI-based investment research platform with over 800 clients, which now covers more than 175,000 private companies and includes PE-specific data sources. These enhancements, along with the capacity of most AI-based investment research tools to incorporate proprietary data from PE firms, are contributing to the growing adoption of AI-powered investment research solutions in the PE space. Early users are experiencing benefits such as a capacity release of around 10% among investment professionals, allowing for a wider investment funnel (more deals screened) at no additional cost.

Portfolio company reporting

AI is proving to be a useful tool for processing and consolidating portfolio company reporting, which is often inconsistent. For instance, a large Canadian institutional investor’s portfolio company value creation team used AI to automate over 92% of the process of creating a consolidated financial view across their portfolio. They were also able to use AI to swiftly identify key metrics or business areas to focus on within each portfolio company. Early adopters have reported benefits like spending up to 30% more time considering specific issue areas rather than just identifying them.

Capital preservation

Identifying and actively managing the risk of permanent capital impairment is an ongoing goal of PE investing, and new AI solutions are emerging to assist investment professionals in this area. One example is Parabole AI, a solution that (i) allows PE investors to describe, in their own words, the types of risks they want to manage proactively; (ii) scans a wide variety of sources, including business news, investment research, and social media, to develop a score for each risk category defined by the PE investors; and, (iii) enables users to easily navigate to the specific paragraphs in the sources that are influencing risk scores. Among the benefits for early adopters, these tools allow for the creation of a consistent view of risk over time, free from cognitive biases, and faster identification of key portfolio companies and areas of focus.

How LeewayHertz’s generative AI solution transforms private equity and principal investment

LeewayHertz’s ZBrain, a groundbreaking generative AI solution, is reshaping the private equity and principal investment sectors with enhanced efficiency and insights, offering a tailored approach to address critical challenges firms face in this sector. With its ability to create highly customized LLM-based applications trained on client’s proprietary data, ZBrain presents a unique opportunity to enhance investment workflows. ZBrain processes diverse business data types, including texts, images, and documents. Leveraging state-of-the-art large language models like GPT-4, FLAN, Vicuna, Llama 2 and GPT-NeoX, it builds context-aware applications that can improve decision-making, deepen insights and boost productivity, all while maintaining strict data privacy standards, making it indispensable for modern investment operations.

Private equity and principal investment sectors face critical challenges in due diligence, including the need for comprehensive vetting of potential investments and transparent insights. Additionally, effective portfolio management is essential, requiring rigorous performance assessment and risk management across complex and diverse investment portfolios.

ZBrain offers a solution to these challenges through specialized “flows.” These flows act as detailed, step-by-step guides, illustrating how ZBrain systematically addresses industry-specific use cases. They enable effortless, code-free business logic creation with their intuitive interface. It easily integrates various large language models, prompt templates, and media models, using drag-and-drop tools to construct and modify sophisticated, intelligent applications.

By harnessing AI-driven automation and advanced data analysis, these flows convert complex data into actionable insights, ensuring increased efficiency, reduced error rates, and an overall improvement in the quality of services, thereby providing solutions to the most pressing problems in the private equity and investment industry. Here are a few of them –

AI-driven due diligence

ZBrain has used its specialized flow for due diligence automation to streamline the process, drastically reducing the time and effort needed. This transformation facilitates quicker deal execution, elevating the overall quality of investment decisions. ZBrain flow’s real-time insights and thorough risk assessment provide a competitive edge, maximizing your investment success and enabling you to capitalize on profitable opportunities. You can explore the specific process flow here to see how ZBrain transforms due diligence and ensures efficient decision-making.

AI-driven portfolio management

ZBrain enhances portfolio performance analysis of private equity and investment firms, increasing efficiency and insightfulness. The streamlined process enables investment managers to make more accurate decisions, freeing up valuable time and resources for strategic decision-making. Integrating AI in portfolio management ensures automated processes, real-time insights, and precise data-driven reports in the competitive investment landscape, keeping firms ahead of the curve. You can discover how ZBrain transforms portfolio management by exploring the detailed process flow here.

How to incorporate AI solutions into private equity and principal investment businesses?

Implementing AI solutions in private equity and principal investment businesses involves a strategic approach tailored to the industry’s needs. Here’s a step-by-step guide:

1. Needs assessment and goal definition:

- Identify key challenges and opportunities that generative AI can address within your business operations.

- Clearly define objectives, such as improving investment decision-making, risk assessment, or optimizing portfolio management.

2. Industry expertise and consulting:

- Collaborate with AI consulting companies with expertise in generative AI technologies and the finance industry.

- Seek guidance on potential applications, benefits, and challenges for private equity and principal investment.

3. Data strategy and preparation:

- Identify relevant data sources, including financial statements, market trends, historical investment data, and economic indicators.

- Ensure data quality and consistency, and address any privacy or regulatory considerations.

4. Technology selection:

- Choose generative AI technologies based on the identified objectives. This may include natural language processing (NLP), machine learning etc.

- Consider scalability, interpretability, and integration with existing systems.

5. Model development and training:

- Develop generative AI models tailored to private equity and principal investment use cases. This could involve creating models for financial forecasting, risk analysis, or investment opportunity identification.

- Train models using historical investment data to learn patterns and trends.

6. Integration with investment processes:

- Develop interfaces to integrate generative AI models into investment decision-making processes seamlessly.

- Ensure real-time capabilities for applications like risk assessment, portfolio optimization, and market trend analysis.

7. Continuous monitoring and optimization:

- Implement systems for real-time monitoring of generative AI applications in the investment process.

- Regularly optimize models based on performance feedback and evolving investment strategies.

8. Feedback mechanisms and iterative improvements:

- Gather feedback from investment professionals to understand the impact of generative AI solutions.

- Use feedback to iterate and enhance generative AI implementations continuously.

LeewayHertz stands as an ideal solution provider for private equity and principal investment businesses, offering unparalleled expertise in crafting and deploying customized generative AI solutions. With a proven track record of innovation and industry-specific knowledge, LeewayHertz offers tailored solutions that elevate decision-making and portfolio management in the finance sector.

How is AI used for lead generation in private equity & principal investment firms?

AI plays a pivotal role in enhancing the lead generation process for private equity and principal investment firms. Its application in the following areas offers significant benefits to these industries:

- Lead qualification: By analyzing extensive customer data, AI can recognize patterns, create Ideal Customer Profiles (ICPs), and pre-qualify leads that fit the target persona. Machine learning software automatically identifies and compiles prospects matching the target audience, offering a ready-to-use list for sales and marketing teams.

- Campaign optimization: AI software can pinpoint the optimal target audiences for B2B marketing campaigns and segment them based on similarities or differences. AI technology can identify high-performing campaigns across various channels and allocate resources accordingly. It can also optimize real-time ad content and Call-to-Actions (CTAs) to enhance campaign response rates.

- Predictive lead scoring: With machine learning techniques such as classification, clustering, and regression, AI can efficiently qualify and score leads. AI models analyze the behavioral patterns of prior leads and the company’s conversion history to rank prospects and predict the time needed to close deals. Sales teams receive a ranked list of leads to prioritize, enabling them to make data-driven decisions rather than relying on guesswork or intuition.

- AI-powered lead engagement: AI technologies, including natural language processing and machine learning, enable automated and personalized engagement across different channels, ensuring leads are nurtured effectively. AI assistants can systematically follow up on leads until they receive a positive response, eliminating human errors like forgetfulness and enhancing lead nurturing opportunities.

- Chatbots: Chatbots, powered by conversational AI, engage customers around the clock across multiple channels. They analyze real-time interactions, assess customer intent, and qualify leads for the sales team. When the interaction becomes too complex for the bot, it can seamlessly hand off the conversation to a live sales representative.

- Personalization: AI-powered tools can customize content for leads based on past browsing and content consumption patterns, driving conversions. Firms can spike interest and drive conversions by delivering hyper-personalized content to leads and online visitors.

- Predictive recommendations: AI tools analyze customer interactions to understand sentiments, interests, pain points, competitor involvement, and overall engagement. These tools provide actionable recommendations on the best steps to take to expedite sales. When an AI tool identifies a customer in the learning phase, it might suggest sharing brochures and demos. Alternatively, if the prospect is near purchase, the tool could advise offering discounts to incentivize the sale.

- Cross-selling and upselling: AI’s predictive recommendations can also highlight opportunities to cross-sell and upsell to existing customers, optimizing the sales process.

In summary, AI offers a multitude of applications throughout the sales funnel for private equity and principal investment firms, from lead qualification and campaign optimization to predictive recommendations and sales analytics. By leveraging AI, these firms can achieve more targeted, efficient lead generation, leading to more successful investment opportunities.

How does AI aid in intelligent investment decision-making?

AI is improving the investment management industry by enhancing the decision-making process through the use of Natural Language Processing (NLP) and Natural Language Generation (NLG). These AI tools enable investment professionals to automate searching and sorting information from vast datasets, allowing them to focus more on making informed investment decisions and recommendations.

NLP translates unstructured data, such as documents, voice, and video, into structured data that machines can process, while NLG creates human-like conversations and written reports from structured data. These AI technologies can be applied to the investment decision process in several ways:

-

Pre-trade: Traditionally, analysts spend considerable time manually searching, sorting, and organizing relevant information to identify and evaluate investment ideas. NLP/G can automate this process by digesting and merging structured and unstructured datasets, seeking patterns and assigning scores to discovered relationships. This technology reduces analysts’ time in this phase, allowing them to focus on more insightful data.

-

Investment decision point: NLP/G can support portfolio managers in making buy, sell, or hold decisions. AI technologies can process data to produce unbiased reports explaining AI-supported decisions, including contrary factors. This allows portfolio managers to review and approve or reject trades and helps investment firms report to portfolio managers, clients, or regulators on the drivers of trade. AI supports investment decisions.

-

Post-investment: NLP/G engines can use structured data inputs to generate performance attribution reports and periodic investor reviews. This technology improves the timing, accuracy, and cost of producing reports based on investment portfolios’ performance and strategy and enables the creation of on-demand reporting for clients.

Investment managers have the opportunity to gain a competitive advantage by adopting NLP/G platforms. NLP/G supports the three phases of the investment decision process, enabling firms to identify investment opportunities sooner, improve operational efficiency, and potentially increase investment performance relative to benchmarks. By freeing people to focus on their most critical human responsibilities, AI technologies like NLP/G have the potential to reshape the core of active management – the investment decision process.

Improving private equity and principal investment strategies with AI agents

AI agents are independent entities designed to achieve specific goals without continuous human oversight, unlike traditional AI models. Operating with predefined objectives, they autonomously generate and execute tasks based on environmental feedback and internal processing. AI agents, propelled by advancements in LLMs like GPT-4, Gemini and Mistral, can reason, plan, execute actions, and evaluate results. Through a multi-step approach, AI agents can tackle complex tasks by breaking them down into manageable sub-steps, reasoning through each step, and refining their strategies based on feedback and observations.

These intelligent agents come in various forms, from simple reflex agents that respond to direct stimuli to sophisticated learning agents that adapt their behavior based on experience. These agents possess a wide range of capabilities, including perceiving dynamic environmental conditions, reasoning, problem-solving, and decision-making. Unlike traditional AI models, AI agents exhibit a higher degree of autonomy, enabling them to operate independently. Additionally, AI agents demonstrate advanced reasoning and decision-making abilities, continually improving their performance through learning and communication.

The versatile role of AI agents in private equity and principal investment

The role of AI agents in private equity and principal investment is multifaceted and impactful, contributing to various aspects of the investment lifecycle. Here are some key roles:

- Data analysis and insights: AI agents analyze vast amounts of financial data, market trends, and economic indicators to identify investment opportunities and assess risk factors. By processing large datasets quickly and accurately, these agents provide valuable insights that inform investment decisions.

- Portfolio optimization: AI agents optimize investment portfolios by leveraging predictive analytics and ML algorithms to identify optimal asset allocation strategies. They continuously monitor market conditions and portfolio performance, adjusting investment allocations in real time to maximize returns and minimize risk.

- Risk management: AI agents contribute substantially to risk management by detecting potential risks and vulnerabilities within investment portfolios. They conduct scenario analysis, stress testing, and risk modeling to evaluate the impact of various market conditions on portfolio performance. By proactively managing risks, these agents help mitigate losses and preserve capital.

- Due diligence: AI agents streamline the due diligence process by automating data collection, analysis, and report generation tasks. They assist investment professionals in conducting thorough research on potential investment opportunities, identifying key drivers of value, and assessing the viability of investment targets.

- Decision support: AI agents provide decision support to investment professionals by analyzing complex data, generating investment recommendations, and predicting future market trends. They assist in evaluating investment opportunities, structuring deals, and optimizing investment strategies based on quantitative analysis and modeling.

Overall, AI agents enhance efficiency, accuracy, and agility in private equity and principal investment operations, enabling investment professionals to make informed decisions, optimize portfolio performance, and achieve superior investment outcomes.

If you seek to optimize your private equity and principal investment operations, LeewayHertz provides tailored AI agent development services designed to meet the unique demands of the financial industry. With expertise in building customized AI agents, we help optimize investment strategies, streamline portfolio management, and improve operational efficiency. We also ensure seamless integration of AI agents into your workflows and systems, empowering your firm to make confident, data-driven decisions.

We specialize in developing intelligent AI agents utilizing advanced tools like AutoGen Studio, TaskWeaver and Crew AI. Whether identifying lucrative investment opportunities, assessing risk factors, or enhancing portfolio performance, our AI agents offer unparalleled efficiency and accuracy.

Partner with LeewayHertz to unlock AI agents’ full potential and propel your private equity and principal investment endeavors into the future. With our advanced AI agent solutions, you can stay ahead of the competition, maximize returns, and navigate the financial landscape with ease.

AI in private equity & principal investment firms: The benefits

Private equity and principal investors increasingly turn to artificial intelligence to help them make better investment decisions, manage risk, and optimize their operations. Here are some of the key benefits of using AI in private equity and principal investment.

A. Improved decision-making

- Data analysis: AI algorithms are extremely adept at analyzing vast amounts of data quickly and accurately. This can be a significant advantage in private equity and principal investing, where investment decisions are often based on complex and multifaceted data sets. With AI, investment professionals can quickly sift through large amounts of data to identify trends, patterns, and insights that might not be immediately apparent to a human analyst.

- Predictive analytics: Another significant advantage of AI is its ability to make predictions based on historical data. By analyzing past investment performance and market trends, AI algorithms can help professionals make more accurate predictions about future investment performance. This can be especially useful in private equity and principal investing, where investments are often made based on long-term projections.

B. Enhanced due diligence

- Automated processes: AI can automate many processes involved in due diligence, making it faster, more accurate, and more efficient. For example, AI algorithms can quickly sift through large amounts of financial and operational data to identify potential risks and red flags, flagging them for further investigation by investment professionals.

- Improved accuracy: By automating due diligence processes, AI can also improve accuracy. AI algorithms are highly precise and can quickly identify discrepancies or irregularities in data sets that human analysts might miss.

- Speed and efficiency: AI can also help speed up the due diligence process. By automating many processes, AI can help investment professionals complete due diligence more quickly, allowing them to make investment decisions faster and more efficiently.

C. Increased operational efficiency

- Workflow automation: AI can automate many of the processes involved in private equity and principal investing, making operations more efficient and reducing the risk of errors or oversights. For example, AI algorithms can automate many of the processes involved in portfolio management, including tracking performance metrics, analyzing data, and generating reports.

- Cost reduction: By automating many of the processes involved in private equity and principal investing, AI can also help reduce costs. This can be especially valuable for smaller firms or individual investors who may not have the resources to hire a large team of analysts or investment professionals.

- Improved performance metrics: AI can also track and analyze performance metrics, providing investment professionals with real-time insights into portfolio performance. This can help them make more informed decisions about where to allocate resources and how to manage risk.

D. Improved portfolio management

- Better insights: AI can provide investment professionals with a wealth of insights into portfolio performance, including risk profiles, investment performance, and market trends. By analyzing this data, investment professionals can make more informed decisions about optimizing their portfolios and managing risk.

- Asset allocation: Finally, AI can help investment professionals optimize asset allocation strategies. By analyzing historical performance data and market trends, AI algorithms can identify investment opportunities likely to generate the best returns and allocate resources accordingly.

Future trends of AI in private equity & principal investment

Artificial intelligence in private equity and principal investing has already shown significant benefits, such as improved decision-making, enhanced due diligence, increased operational efficiency, and improved portfolio management. As technology continues to advance, several trends in AI are likely to impact the private equity and principal investing industry in the future.

Natural Language Processing (NLP)

One of the most significant trends in AI is natural language processing (NLP), which involves training algorithms to understand and interpret human language. NLP can positively impact how private equity and principal investors analyze and interpret financial data, as it can process vast amounts of unstructured data, such as financial news articles and social media posts, to identify trends and patterns that could affect investment decisions.

Autonomous decision-making

AI algorithms can make decisions autonomously without human intervention as they become more sophisticated. This could significantly improve the speed and efficiency of investment decision-making, as algorithms can analyze data quickly and make investment recommendations based on predetermined criteria.

Increased use of machine learning

Machine learning, a type of AI that enables algorithms to learn and improve over time, is already used in the private equity and principal investing industry. Machine learning will likely increase as algorithms become more advanced and can better identify investment opportunities and risks.

Blockchain integration

Blockchain technology, which enables secure and transparent record-keeping, has the potential to transform the way private equity and principal investing transactions are conducted. By integrating AI with blockchain technology, investment professionals can quickly and securely analyze investment opportunities and execute transactions, reducing costs and increasing efficiency.

Enhanced cybersecurity

As the use of AI in private equity and principal investing continues to grow, so does the risk of cybersecurity breaches. In the future, AI will enhance cybersecurity by analyzing data and identifying potential security threats in real-time, enabling investment professionals to respond quickly and effectively to any security breaches.

Conclusion

The use of artificial intelligence in private equity and principal investment firms has transformed how investment professionals analyze and interpret financial data. By leveraging AI to enhance decision-making, due diligence, operational efficiency, and portfolio management, private equity firms and principal investors can achieve better investment outcomes and improve their overall performance.

As technology advances, future trends such as natural language processing, autonomous decision-making, machine learning, blockchain integration, and enhanced cybersecurity will likely improve the speed, efficiency and accuracy of investment decision-making. While AI presents significant opportunities for private equity and principal investment, it is important to note that it does not replace human expertise. Investment professionals must continue to use their judgment and experience to make informed decisions and ensure that AI is used ethically and responsibly.

The future of AI in private equity and principal investment is promising, and investment professionals who embrace this technology are likely to gain a competitive edge in the market and achieve better investment outcomes.

Transform your investment strategy with AI-powered software tailored for private equity & capital investment. Contact LeewayHertz AI developers today to know more about AI development services.

Listen to the article

Start a conversation by filling the form

All information will be kept confidential.

FAQs

How is AI transforming private equity and principal investment businesses?

AI is driving a significant transformation in the private equity and principal investment sectors by introducing automation and advanced analytics. It is reshaping traditional practices in the following ways:

- Automated decision-making processes: AI in private equity and principal investment enables investment screening and due diligence automation, allowing firms to process vast amounts of data efficiently. This automation enhances decision-making by providing timely and accurate insights.

- Data analysis and predictive modeling: Investors leverage AI to analyze structured and unstructured data, identifying patterns and generating predictive models. This data-driven approach enhances the accuracy of investment decisions and supports long-term portfolio strategies.

- Optimized exit strategies: AI aids in optimizing exit strategies by analyzing market trends and industry insights. It helps firms make well-informed decisions on the timing and route of exits, ultimately maximizing investment returns.

- Efficient lead generation: Private equity firms use AI for lead generation by analyzing data from various sources. AI-driven tools can identify potential investment targets, personalize communications, and increase the likelihood of successful engagement with prospective companies.

- Enhanced portfolio management: AI assists in monitoring Key Performance Indicators (KPIs), detecting trends, and predicting potential issues in portfolio companies. This portfolio management optimization contributes to more efficient resource allocation and better overall performance.

What are some key AI use cases and applications in private equity and principal investment?

Prominent AI use cases in this domain include investment screening and analysis, due diligence, portfolio management, exit strategies, risk management, and deal sourcing. These applications streamline processes, enhance decision-making, and improve overall efficiency.

How does AI aid in intelligent investment decision-making?

AI, specifically Natural Language Processing (NLP) and Natural Language Generation (NLG), automates information searching and sorting from vast datasets. It supports investment professionals in making informed decisions by processing unstructured data and generating human-like reports.

How does AI contribute to optimizing portfolio management in private equity firms?

AI contributes to optimizing portfolio management in private equity firms through various key mechanisms:

- Predictive analytics: AI employs advanced predictive analytics to forecast market trends, identify investment opportunities, and assess potential risks, aiding in informed decision-making for portfolio managers.

- Risk management: AI models analyze historical data and market indicators to identify potential risks, helping portfolio managers implement proactive risk management strategies and ensure the stability of the investment portfolio.

- Performance monitoring: AI-driven tools continuously monitor the performance of individual assets within a portfolio, providing real-time insights and enabling prompt adjustments to optimize returns and mitigate underperforming investments.

- Automation of routine tasks: AI automates repetitive tasks, such as data analysis and reporting, allowing portfolio managers to focus on strategic decision-making rather than being burdened by manual processes.

- Personalized investment strategies: AI algorithms analyze diverse data sources, including market news, economic indicators, and social sentiment, to tailor investment strategies based on individual client preferences and market conditions.

- Efficient asset allocation: AI optimizes asset allocation by analyzing historical performance, market trends, and economic indicators, ensuring a well-balanced and diversified portfolio that aligns with the investment goals and risk tolerance of the firm and its clients.

- Enhanced due diligence: AI streamlines the due diligence process by rapidly analyzing large datasets related to potential investments, enabling portfolio managers to make well-informed decisions efficiently.

In summary, AI significantly enhances portfolio management in private equity firms by providing advanced analytics, automating routine tasks, optimizing asset allocation, and facilitating more informed decision-making processes.

In what ways does AI assist in risk management within the private equity sector?

AI plays a pivotal role in enhancing risk management within the private equity sector through several key mechanisms:

- Predictive analytics: AI utilizes predictive analytics to assess historical data, market trends, and various economic indicators, enabling more accurate forecasting of potential risks associated with specific investments.

- Risk identification: AI algorithms analyze diverse data sources to identify and categorize potential risks, including market volatility, economic downturns, and industry-specific challenges, providing comprehensive insights for risk assessment.

- Fraud detection: AI employs advanced algorithms to detect anomalies and patterns indicative of fraudulent activities, helping private equity firms mitigate the risks associated with financial irregularities and fraudulent transactions.

- Portfolio stress testing: AI conducts stress tests on investment portfolios, simulating various economic scenarios to evaluate how different factors may impact the overall performance of the portfolio, thereby assisting in risk mitigation and strategic planning.

- Real-time monitoring: AI continuously monitors market conditions, regulatory changes, and global events in real-time, enabling private equity professionals to promptly respond to emerging risks and make informed decisions to protect the portfolio.

- Operational risk management: AI streamlines operational risk management by automating routine tasks, identifying potential operational inefficiencies, and ensuring compliance with regulatory requirements, reducing the likelihood of operational disruptions.

- Natural Language Processing (NLP): AI, particularly NLP, analyzes vast amounts of textual data from news, reports, and regulatory updates to extract relevant information, providing a comprehensive understanding of the external factors influencing risk within the private equity landscape.

- Scenario analysis: AI conducts scenario analysis, assessing the potential impact of various scenarios on the portfolio, helping private equity firms develop robust risk mitigation strategies and contingency plans.

In summary, AI assists in risk management within the private equity sector by leveraging predictive analytics, real-time monitoring, fraud detection, and operational efficiency, providing valuable tools for private equity professionals to identify, assess, and mitigate risks effectively.

How will my private equity business benefit from LeewayHertz's AI development services?

LeewayHertz provides valuable AI development services to private equity companies:

- Predictive analytics tools: LeewayHertz develops advanced predictive analytics tools to forecast market trends, assess investment risks, and identify potential opportunities for private equity firms.

- Portfolio optimization solutions: LeewayHertz develops AI-powered tools for optimizing portfolio performance by analyzing market conditions, assessing risk factors, and recommending strategic adjustments.

- Fraud detection tools: The company implements AI algorithms to detect anomalies and patterns indicative of fraudulent activities, enhancing the security of financial transactions and mitigating the risks associated with financial irregularities.

- Operational efficiency: They streamline operational processes through AI automation, reducing manual efforts, and enhancing efficiency in areas such as data management, reporting, and compliance.

- Decision support systems: They develop AI-powered decision support systems that provide real-time insights, enabling private equity professionals to make informed decisions on investments, risk management, and portfolio strategies.

- Natural Language Processing (NLP): They build tools equipped with NLP capabilities to analyze textual data from diverse sources, such as news articles and reports, providing comprehensive insights into market sentiment and regulatory developments.

- Scenario analysis tools: Build scenario analysis tools that simulate various economic conditions, allowing private equity firms to assess the potential impact on their portfolios and develop robust risk mitigation strategies.

- Continuous monitoring: Develop systems for real-time monitoring of market conditions, enabling your firm to respond to emerging risks and capitalize on investment opportunities promptly.

- AI-driven reporting: Create AI-driven reporting solutions that offer detailed insights into portfolio performance, risk exposure, and compliance, facilitating transparent and data-driven communication with stakeholders.

By harnessing LeewayHertz’s AI development services, your private equity business can benefit from cutting-edge technologies to optimize operations, enhance decision-making processes, and stay ahead in a dynamic and competitive financial landscape.