Banking Software Development

AI and Machine Learning provide an opportunity for banks to improve relationships with customers, compete for the best business and gain market presence and share while preventing financial crime and complying with regulations.

AI Will Give Rise To FinTech 2.0 And Longevity Banks

Banking and Artificial Intelligence

Consumers and companies both want banks to understand who they are, predict their desires and provide them better solutions. Banks have to offer these solutions seamlessly across multiple channels, providing easy access from anywhere on any device. They have to strengthen existing relations with clients while looking for new clients in the market and compete for the business instead of waiting for the business to reach them. AI has the potential to fulfill all these goals by using your data about clients, how their requirements have changed and what are their channel preferences.

Client Experience

- Improve relationships with clients

- Understand client needs and find new needs when they arise

- Identify which client requires what service or product

- Leverage analytics to understand client preferences and price budget

- Make sure that the client receives the best support whenever they need it

- Target offers precisely

Financial Markets

- Enhance pricing and identify the best business opportunities

- Reduction in the back and middle office costs from error correction and process failures

- Improve trade execution and routing

- Connect investors with the right investment opportunities

- Share research report with the right clients

Lending

- Offer insights into an individual’s credit insights

- Digital Footprint Analysis of an Applicant’s Profile

- Improve risk-adjustment margins

- Improve customer experience

- Target more customers

- Predict losses accurately

“The aggregate potential cost savings for banks from AI applications is estimated at $447 billion by 2023, with the front and middle office accounting for $416 billion of that total.”

AI Leveraging Banking Industry

There are lots of use cases of AI and Machine Learning that can be implemented across the banks. Both small and large banks leverage automated machine learning to reduce operational costs and bring revenue growth while enhancing quality, mitigating risks and improving efficiency.

Credit

The one who has the best model wins in the world of credit. Banks are leveraging machine learning to develop models for evaluating loss severity, default probability and loss forecasting. They have started using these models to enhance credit approval, portfolio management and pricing for risk. Leveraging machine learning to build such models makes credit scoring precise as models can learn from the behavior of different individuals.

Financial Crime

Preventing financial crimes, especially frauds and money laundering, is crucial than ever and is challenging as hackers/criminals are becoming smarter. With Machine Learning, banks can learn from fraud losses and investigational findings and training models to identify suspicious activity and to prevent fraud in real-time. These models get better with more learning from time to time.

Marketing

Banks are applying machine learning to their models to predict which clients can get more profit to their business and are creating a smart strategy to prioritize referrals and leads. They learn from their clients’ behavior to target their offers accurately. They are using analytics to understand client price sensitivity, evaluate price-volume elasticity and customize their value proposition.

Client Experience

Clients want banks to know who they are, what they require and when they require it. Banks are leveraging machine learning to analyze client requirements. They also learn from the complaints of clients so that they could take action immediately. Also, banks are developing predictors of traffic volume to provide better staffing

Cash Management

Banks use machine learning to identify prepayment speed and new loan demand and to predict ATM cash requirements. They use historical data about cash inflows and outflows to build models for predicting cash flows. It allows them to have the required cash amount on hand whenever and wherever they need it.

Global Markets

Traders use historical transaction cost analysis and execution data to develop models for optimizing trade execution strategy and order routing. These models asses the merits of the potential algorithmic trading approaches, counterparties and venues. Also, these models support trader decision making and help reduce market impact and cost while recording the trader’s compliance with the best execution needs.

Our Work in Banking Software Development

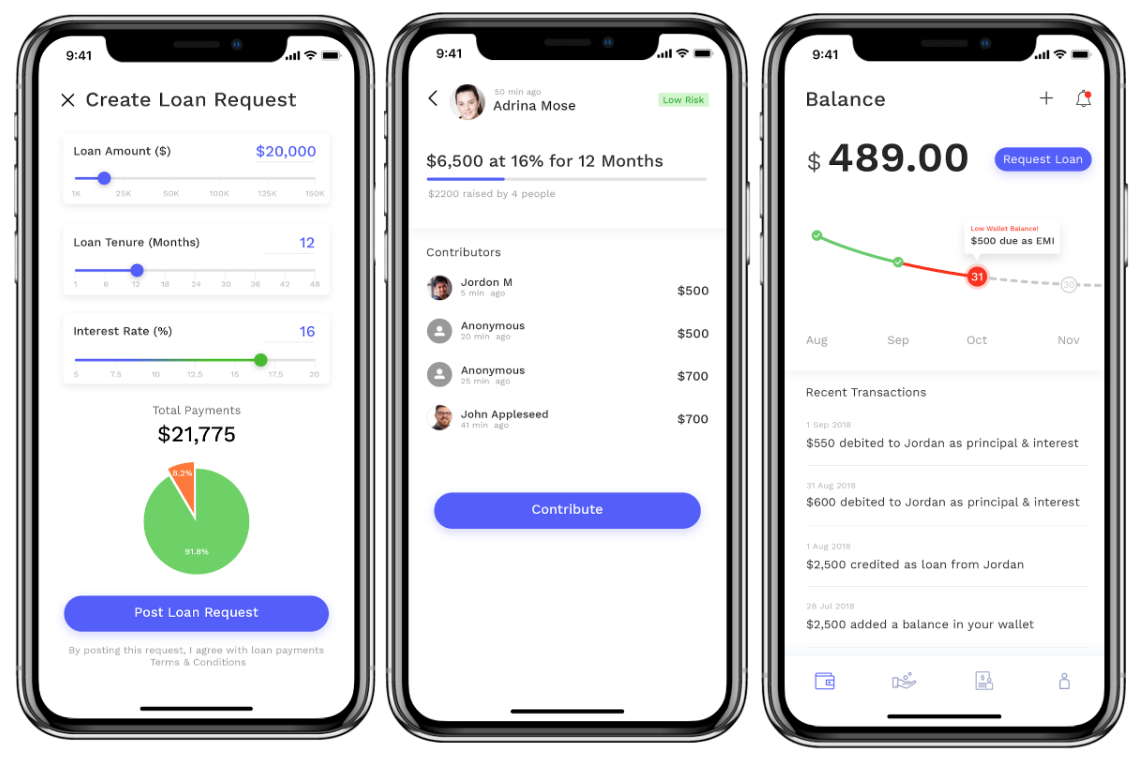

P2P LENDING PLATFORM

HashLend: An application for Peer to Peer Lending, on the top of Hedera Hashgraph Platform

LeewayHertz has successfully developed HashLend, an application for Peer to Peer Lending on the Hedera Hashgraph platform. HashLend is a scalable and robust application that enables borrowers and lenders to connect directly without the involvement of middlemen or intermediaries

Our Engagement Models

Dedicated Development Team

Our developers leverage cutting-edge cognitive technologies to deliver high-quality services and tailored solutions to our clients.

Team Extension

Our team extension model is designed to assist clients seeking to expand their teams with the precise expertise needed for their projects.

Project-based Model

Our project-oriented approach, supported by our team of software development specialists, is dedicated to fostering client collaboration and achieving specific project objectives.

Get Started Today

1. Contact Us

Fill out the contact form protected by NDA, book a calendar and schedule a Zoom Meeting with our experts.

2. Get a Consultation

Get on a call with our team to know the feasibility of your project idea.

3. Get a Cost Estimate

Based on the project requirements, we share a project proposal with budget and timeline estimates.

4. Project Kickoff

Once the project is signed, we bring together a team from a range of disciplines to kick start your project.

What can we do for you? Let’s talk

Once you let us know your requirement, our technical expert will schedule a call and discuss your idea in detail post sign of an NDA.

All information will be kept confidential.

Insights

What is Serverless Architecture and how it works?

Serverless Architecture is a software design model where a third-party service hosts applications and removes the need for server hardware and software management.

Digital Transformation in Banking

Digital Transformation in Banking allows financial institutes to know what customers want and strengthen customer engagement with personalized offerings.

Impact of Cloud Computing in Healthcare Industry

Cloud Computing in healthcare sector allows care providers to store patient data on the cloud while avoiding costs of maintaining physical servers.