Finance and Banking

AI-driven Contract Analysis for Informed Financial Decision-making and Risk Reduction

Utilizing ZBrain for Enhanced Contract Management Efficiency

Time-consuming Manual Contract Analysis

In the finance and banking industry, effective contract analysis is essential for ensuring compliance, managing risk, and optimizing financial performance. Traditional contract analysis methods are often labor-intensive, error-prone, and time-consuming, making it challenging for finance and banking professionals to stay on top of contractual obligations and opportunities. ZBrain offers a streamlined approach to contract analysis, elevating the quality of decision-making processes.

I. How ZBrain Streamlines Contract Analysis

ZBrain leverages the capabilities of artificial intelligence and machine learning to streamline and automate the traditionally labor-intensive contract analysis process. Here’s a comparison of the time required for each contract analysis task with and without ZBrain:

| Steps | Without ZBrain Flow | Time Without ZBrain Flow | With ZBrain Flow |

|---|---|---|---|

| Data Acquisition | Manual | ~6 hours | Automated by ZBrain Flow |

| Data Cleaning and Preparation | Manual | ~8 hours | Automated by ZBrain Flow |

| Data Analysis | Manual | ~10 hours | Automated by ZBrain Flow |

| Report Generation | Manual | ~6 hours | Automated by ZBrain Flow |

| Report Review | Manual | ~2 hours | Manual |

| Total | ~32 hours | ~4 hours |

As illustrated in the table, ZBrain significantly reduces the time spent on the financial contract analysis process from approximately 32 hours to just around 4 hours, resulting in substantial time and cost savings.

II. Required Input Data

For ZBrain to perform at its best and provide accurate output, it relies on the following essential data:

| Information Source | Description | Recency |

|---|---|---|

| Internal Contract Repository | Historical contract data and templates used for reference, analysis, and management of the organization’s contractual agreements. | Always updated |

| Regulatory Documents and Guidelines | Documents and guidelines with the latest industry standards and regulations. | Last 6 months |

| Customer-Specific Legal Requirements | Unique legal stipulations for clients. | Current contracts |

| Financial Data and Key Metrics | Financial terms, monetary amounts, and key performance indicators. | Last fiscal year |

| Legal Precedents | Past legal cases and outcomes relevant to terms. | Last 2 years |

III. ZBrain Flow: How It Works?

Step 1: Data Acquisition and Exploratory Data Analysis (EDA)

ZBrain initiates the contract analysis process by collecting various sources of contract data, including contract documents, legal and regulatory updates, historical contract data and risk assessment data. Subsequently, an automated EDA is executed on the accumulated dataset to assess the current state of contractual adherence and identify potential areas of concern.

Step 2: Embedding Generation

In this phase, ZBrain employs advanced techniques to transform textual contract data, encompassing the content of various agreements, past deviations, and compliance issues, into numerical embeddings. These embeddings capture intricate data relationships, providing the foundation for comprehensive analysis and enhancing ZBrain’s ability to identify contract irregularities and offer precise compliance recommendations.

Step 3: Query Execution and Contract Analysis

Upon the user’s request, ZBrain conducts a thorough analysis of the organization’s contract compliance using the OpenAI Language Model (LLM). This analysis results in a comprehensive report that highlights any contract deviations and offers actionable recommendations.

Leveraging the embeddings, the OpenAI LLM can provide deep insights, pinpointing areas of concern and delivering actionable guidance for adherence to contractual terms.

Step 4: Parsing the Generated Report

After the LLM generates the report, ZBrain uses a rigorous parsing method to enhance the report and extract pertinent insights. This meticulous approach guarantees compliance officers obtain accurate, actionable, and timely recommendations for effectively managing contract-related issues.

Improved Contract Management

Through automated contract analysis, ZBrain dramatically reduces the time and resources needed for contract management in the finance and banking sectors. The conventional manual process, which demands approximately 32 hours, has now been refined to a mere 4 hours, delivering significant time and cost efficiencies. This empowers finance and banking professionals to quicken contract evaluations precisely, fostering informed decision-making, streamlined compliance, and effective risk management. Harness the power of ZBrain to elevate contract management and drive financial optimization within the finance and banking industry.

Prompt:

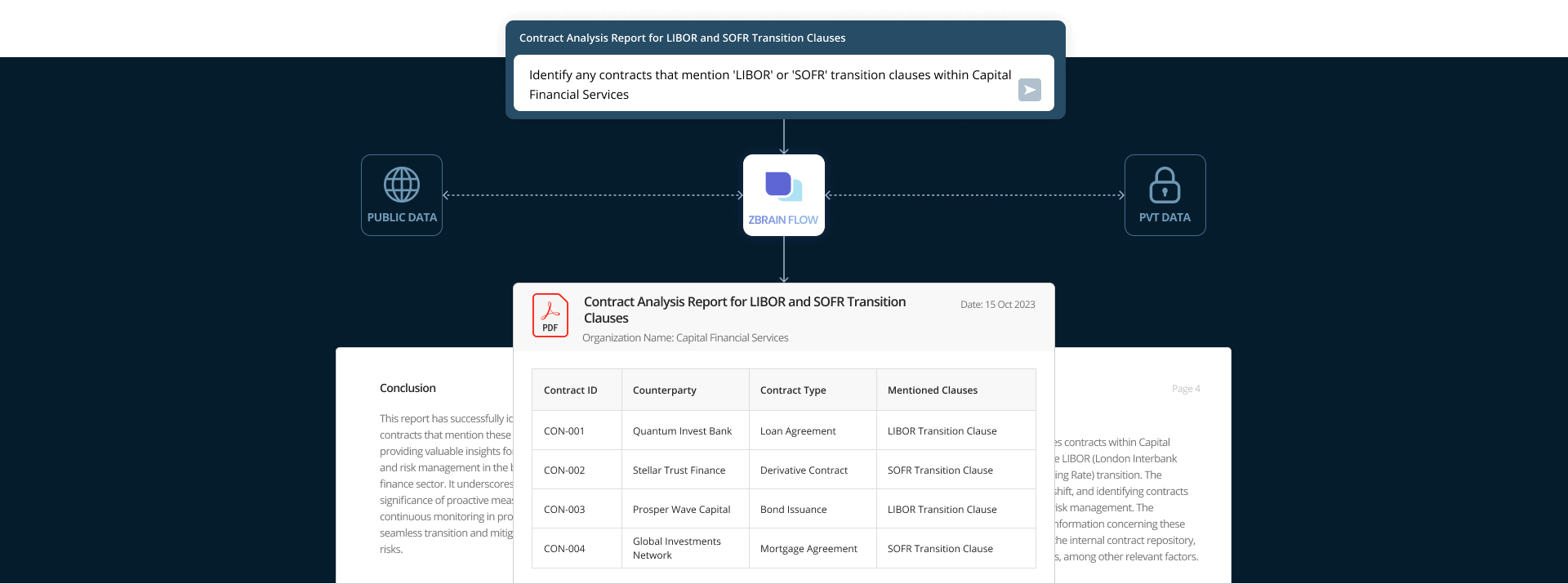

Identify any contracts that mention ‘LIBOR’ or ‘SOFR’ transition clauses within Capital Financial Services

Executive Summary

This contract analysis report identifies and evaluates contracts within Capital Financial Services that contain clauses related to the LIBOR (London Interbank Offered Rate) and SOFR (Secured Overnight Financing Rate) transition. The transition from LIBOR to SOFR is a critical industry shift, and identifying contracts with these clauses is essential for compliance and risk management. The assessment has been enhanced by incorporating information concerning these counterparties, which includes data sourced from the internal contract repository, financial data and key metrics, and legal precedents, among other relevant factors.

1. Contract Identification

The analysis involved a comprehensive search across the institution’s contract repository to identify contracts mentioning LIBOR or SOFR transition clauses. The search yielded the following results:

| Contract ID | Counterparty | Contract Type | Mentioned Clauses |

|---|---|---|---|

| CON-001 | Quantum Invest Bank | Loan Agreement | LIBOR Transition Clause |

| CON-002 | Stellar Trust Finance | Derivative Contract | SOFR Transition Clause |

| CON-003 | Prosper Wave Capital | Bond Issuance | LIBOR Transition Clause |

| CON-004 | Global Investments Network | Mortgage Agreement | SOFR Transition Clause |

2. Contract Analysis

In this contract analysis, agreements with various financial institutions have been reviewed, each focusing on LIBOR and SOFR transition clauses. Here are the key findings for each contract:

- CON-001 – Loan Agreement with Quantum Invest Bank

-

Contract Type: Loan Agreement

-

Mentioned Clauses: LIBOR Transition Clause

Analysis: The contract with Quantum Invest Bank contains a LIBOR transition clause, indicating that the institution is actively addressing the shift from LIBOR to SOFR for this particular loan agreement. It is essential to monitor the transition process and ensure compliance.

- CON-002 – Derivative Contract with Stellar Trust Finance

-

Contract Type: Derivative Contract

-

Mentioned Clauses: SOFR Transition Clause

Analysis: The derivative contract with Stellar Trust Finance includes a SOFR transition clause, reflecting the institution’s commitment to adhering to the industry’s transition standards for derivative products. This highlights the institution’s proactive approach to risk management.

- CON-003 – Bond Issuance with Prosper Wave Capital

-

Contract Type: Bond Issuance

-

Mentioned Clauses: LIBOR Transition Clause

Analysis: The bond issuance contract with Prosper Wave Capital mentions a LIBOR transition clause, emphasizing the importance of adapting to the new SOFR rate in bond-related transactions. Monitoring and complying with this clause is crucial.

- CON-004 – Mortgage Agreement with Global Investments Network

-

Contract Type: Mortgage Agreement

-

Mentioned Clauses: SOFR Transition Clause

Analysis: The mortgage agreement with Global Investments Network incorporates a SOFR transition clause, indicating the institution’s commitment to ensuring a smooth transition in the mortgage lending sector. This clause emphasizes the institution’s risk management strategy.

Recommendations

- Continuously monitor and track the transition process for contracts with LIBOR transition clauses, ensuring compliance with industry standards.

- Keep up-to-date on developments in SOFR-related products and derivatives, as indicated by contracts with SOFR transition clauses, to effectively manage associated risks.

- Implement a proactive approach to educate relevant teams and stakeholders about the implications of LIBOR to SOFR transition clauses in contracts.

- Maintain clear communication with counterparties, such as Quantum Invest Bank, Stellar Trust Finance, Prosper Wave Capital and Global Investments Network, to ensure a smooth transition process.

Conclusion

This report has successfully identified contracts that mention these clauses, providing valuable insights for compliance and risk management in the banking and finance sector. It underscores the significance of proactive measures and continuous monitoring in providing a seamless transition and mitigating potential risks.