Utilizing Artificial Intelligence in Portfolio Management for Private Equity and Investment Firms

Challenges of Portfolio Performance Analysis

Crafting the perfect investment strategy relies on a comprehensive and accurate analysis of your portfolio companies’ performance. Yet, sifting through extensive and intricate data can pose challenges and consume valuable time. Artificial Intelligence in portfolio management facilitated by ZBrain simplifies portfolio performance analysis by automating the process, ensuring you make informed decisions efficiently and effectively.

I. How ZBrain Flow Streamlines the Process

Discover the remarkable time savings and efficiency ZBrain Flow brings to portfolio performance analysis with this comprehensive comparison table for each step with and without ZBrain Flow:

|

Steps |

Without ZBrain Flow |

Time Without ZBrain Flow |

With ZBrain Flow |

|---|---|---|---|

| Data acquisition | Manual | ~4 hours | Automated by ZBrain Flow |

| Data cleaning and preparation | Manual | ~4 hours | Automated by ZBrain Flow |

| Data analysis | Manual | ~5 hours | Automated by ZBrain Flow |

| Report generation | Manual | ~6 hours | Automated by ZBrain Flow |

| Report review and finalization | Manual | ~2 hours | Manual |

| Total | ~21 hours | ~3 hours |

II. Necessary Input Data

|

Information Source |

Description |

Recency |

|---|---|---|

| Financial statements | Comprehensive information about the company’s financial health and profitability. | Last fiscal year |

| Market data | Data on share prices, trading volumes, and indices to understand company’s market performance and positioning. | Real-time or as required |

| Economic indicators | Information on economic conditions like GDP growth rate, inflation rate, unemployment rate, consumer sentiment index, etc. | Latest published data |

| Industry-specific metrics | Depending on the industry, certain metrics may be particularly important like user growth, churn rate, average revenue per user in the software industry. | As required |

| Competitor data | Information about a company’s competitors can provide context for understanding its performance. | As required |

| Regulatory information | Data about the regulatory environment, including information about compliance, fines, and changing regulations. | As published |

| Macroeconomic data | Macro trends, such as interest rates, exchange rates, and political conditions. | Latest published data |

| Credit ratings | Credit ratings providing insights into the company’s creditworthiness and financial stability. | Last published rating |

| Management and governance information | Information about the company’s management team, board of directors, governance structure, and any changes in these areas. | As published |

III. ZBrain Flow: How It Works

Step 1: Data Acquisition and EDA

ZBrain automatically pulls relevant data such as financial statements, performance records, and credit ratings from various sources. It then initiates automated Exploratory Data Analysis to unveil valuable insights, such as correlations, outliers, and trends within the data that can influence investment decisions. ZBrain’s AI-powered analytics conduct advanced data analysis and benchmarking against industry peers, identifying performance trends and insights and providing dynamic visualizations and reports for easy comparison and evaluation.

Step 2: Embedding Generation

ZBrain transforms textual data into numerical representations using advanced embedding techniques for efficient data analysis. These embeddings capture the semantic meaning and relationships between different data points, enabling efficient retrieval and analysis.

Step 3: Query Execution and Report Generation

Whenever a user submits a query for portfolio performance analysis, ZBrain fetches relevant data and passes it to the OpenAI or Language Model (LLM) for report generation. The LLM dynamically generates a comprehensive and coherent report based on the user inputs. ZBrain’s financial modeling capabilities perform comprehensive financial performance evaluations, analyzing revenue, expenses, cash flow, and balance sheets. ZBrain’s sustainability insights evaluate portfolio companies’ adherence to ESG (Environmental, Social, and Governance) framework and their impact on long-term business performance.

Step 4: Parsing the Generated Report

After generating the performance report, ZBrain expertly extracts essential information like growth rates, performance evaluations, financial health indicators, and investment recommendations. The parsed data is meticulously structured, ensuring it adheres precisely to the desired format and guidelines. This careful approach guarantees that the final output is concise, accurate, and presented in a professional manner, providing you with valuable insights to drive informed investment decisions.

Optimized Portfolio Analysis

ZBrain Flow empowers private equity and investment firms to optimize portfolio performance analysis, making it more efficient and insightful. Reducing the time and effort required for portfolio performance analysis from 21 hours to just 3 hours, ZBrain Flow enables investment managers to make quicker, more accurate decisions. This significant time savings allow investment firms to allocate more resources to strategic decision-making and seize opportunities faster. Artificial Intelligence in portfolio management helps you stay ahead in the competitive investment landscape with automated processes, real-time insights, and precise data-driven reports.

Prompt:

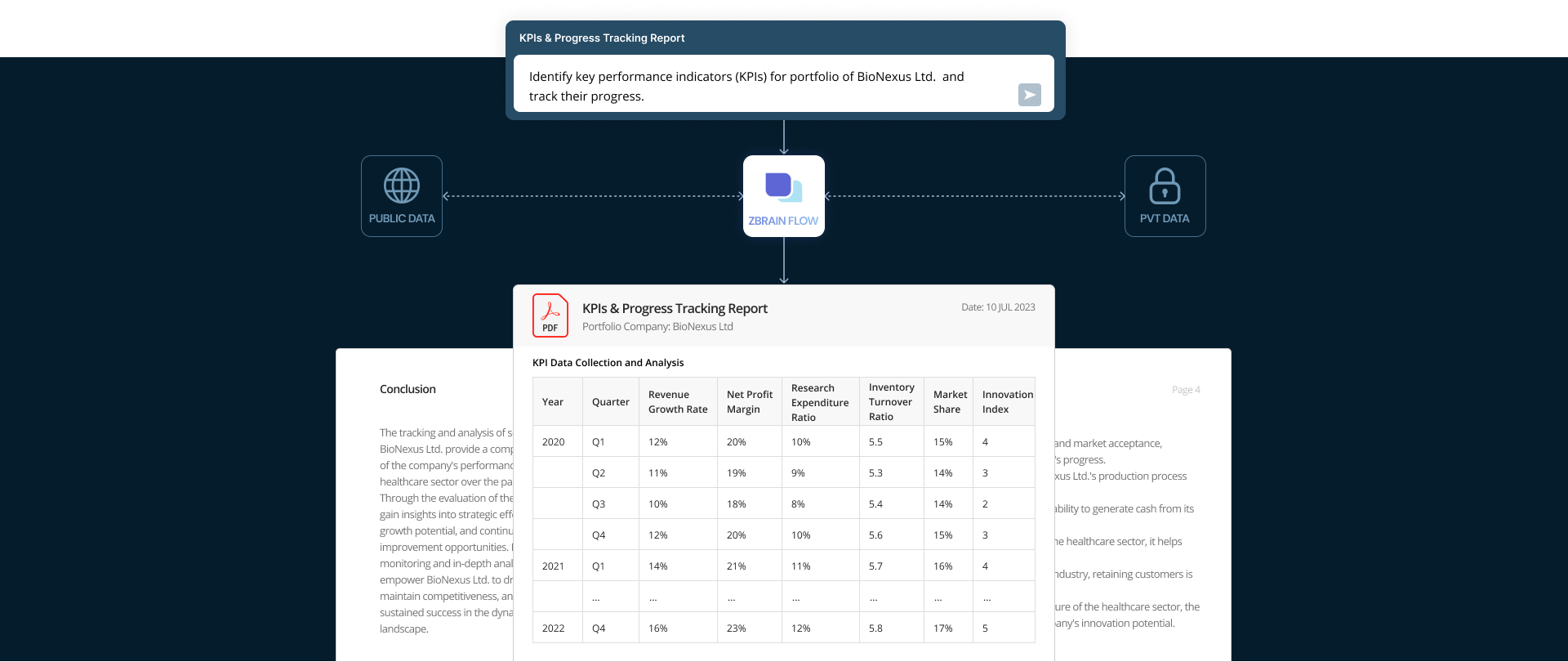

Identify key performance indicators (KPIs) for the portfolio of BioNexus Ltd. and track their progress.

Portfolio Performance Analysis Report for BioNexus Ltd.

Introduction:

This report outlines the selection and tracking of key performance indicators (KPIs) for BioNexus Ltd., a prominent healthcare sector player. Over the past three years, we have monitored and analyzed these KPIs to assess the company’s performance, strategic alignment, and growth trajectory.

Selected Key Performance Indicators:

A set of KPIs has been selected to gauge BioNexus Ltd.’s performance across various aspects, encompassing financial, operational, and strategic dimensions.

|

KPI Category

|

Key Performance Indicator

|

Description

|

|---|---|---|

| Financial performance | Revenue growth rate | Annual growth rate of total revenue |

| Net profit margin | Net profit as a percentage of total revenue | |

| Operational efficiency | Research expenditure ratio | R&D expenses as a percentage of total expenses |

| Inventory turnover ratio | Efficiency of inventory management | |

| Strategic alignment | Market share | Proportion of the market served by BioNexus Ltd. |

| Innovation index | Number of new product innovations |

Data Collection and Analysis:

Data has been collected and analyzed quarterly over the past three years for the selected KPIs. This analysis unveils trends, deviations, and interrelations across these KPIs, offering insights into BioNexus Ltd.’s strengths and areas for improvement.

Table 2: KPI Data Collection and Analysis

|

Year

|

Quarter

|

Revenue Growth Rate (%)

|

Net Profit Margin (%)

|

Research Expenditure Ratio (%)

|

Inventory Turnover Ratio

|

Market Share (%)

|

Innovation Index

|

|---|---|---|---|---|---|---|---|

| 2020 | Q1 | 12 | 20 | 10 | 5.5 | 15 | 4 |

| Q2 | 11 | 19 | 9 | 5.3 | 14 | 3 | |

| Q3 | 10 | 18 | 8 | 5.4 | 14 | 2 | |

| Q4 | 12 | 20 | 10 | 5.6 | 15 | 3 | |

| 2021 | Q1 | 14 | 21 | 11 | 5.7 | 16 | 4 |

| Q2 | 13 | 20 | 10 | 5.8 | 17 | 3 | |

| Q3 | 12 | 19 | 9 | 5.9 | 17 | 3 | |

| Q4 | 15 | 22 | 12 | 6.0 | 18 | 4 | |

| 2022 | Q1 | 16 | 23 | 12 | 6.1 | 19 | 5 |

| Q2 | 15 | 22 | 11 | 6.2 | 20 | 4 | |

| Q3 | 14 | 21 | 10 | 6.3 | 20 | 4 | |

| Q4 | 17 | 24 | 13 | 6.4 | 21 | 5 |

Progress Tracking and Insights:

-

Revenue Growth: BioNexus Ltd. consistently achieved quarterly growth rates between 10% and 17%, reflecting successful market penetration and effective sales strategies.

-

Profitability: Net profit margin increased from 20% to 24% over three years, indicating improved cost management and operational efficiency.

-

Innovation Commitment: The company’s allocation of 8% to 13% of revenue to research and development demonstrates a proactive approach to innovation and staying competitive.

-

Inventory Management: BioNexus Ltd. maintained a stable inventory turnover ratio (5.3 to 6.4), showcasing effective inventory management practices.

-

Market Share: Steady growth in market share from 14% to 21% implies successful strategies in product innovation, marketing, and pricing.

-

Innovation Culture: The innovation index’s rise from 2 to 5 reflects BioNexus Ltd.’s investment in R&D, fostering innovation, and introducing customer-oriented products.

Conclusion:

The tracking and analysis of selected KPIs for BioNexus Ltd. provide a comprehensive view of the company’s performance in the healthcare sector over the past three years. Through the evaluation of these metrics, we gain insights into strategic effectiveness, growth potential, and continuous improvement opportunities. Regular monitoring and in-depth analysis of KPIs empower BioNexus Ltd. to drive innovation, maintain competitiveness, and achieve sustained success in the dynamic healthcare landscape.