Finance and Banking

Smart Choices, Efficient Outcomes: Optimize Financial Product Recommendations Using AI

Leverage ZBrain for Targeted Financial Product Recommendations and Enhanced Customer Engagement

Challenges in Conventional Financial Product Recommendations

Choosing the right financial products is essential to ensuring individual and institutional financial success. The complexities of analyzing diverse financial offerings and the sheer volume of available data make the traditional process time-consuming and often overwhelming. ZBrain addresses these challenges by optimizing product recommendations in the banking and finance sector, fostering efficient and effective decision-making, and elevating efficiency, personalization, and customer engagement to new heights.

I. How ZBrain Refines Product Recommendations

Leveraging artificial intelligence and machine learning, ZBrain automates the traditionally manual product recommendation process. Below is a comparison of the time required for each task with and without ZBrain Flow:

| Steps | Without ZBrain Flow | Time Without ZBrain Flow | With ZBrain Flow |

|---|---|---|---|

| Data acquisition | Manual | ~6 hours | Automated by ZBrain Flow |

| Data cleaning and Preparation | Manual | ~6 hours | Automated by ZBrain Flow |

| Data analysis | Manual | ~10 hours | Automated by ZBrain Flow |

| Report generation | Manual | ~8 hours | Automated by ZBrain Flow |

| Report review and finalization | Manual | ~2 hours | Manual |

| Total | ~32 hours | ~3 hours |

As depicted in the table, ZBrain significantly reduces the time spent on the product recommendation process from approximately 32 hours to just around 3 hours, resulting in substantial time and cost savings.

II. Necessary Input Data

For ZBrain to deliver optimal product recommendations, it requires the following data:

| Information Source | Description | Recency |

|---|---|---|

| Customer transaction history | Records of past transactions and spending patterns | Always updated |

| Credit scores and reports | Information on the customer’s creditworthiness | Last 3 months |

| Investment portfolio | Details of customer investments and risk appetite | Last 6 months |

| Digital interactions and preferences | Online and app usage data, behavior analytics including preferences and clicks | Last 1 month |

| Economic and market trends | Relevant market trends affecting financial products | Last 3 months |

| Product performance metrics | Data on the performance of various products to inform recommendations | Always updated |

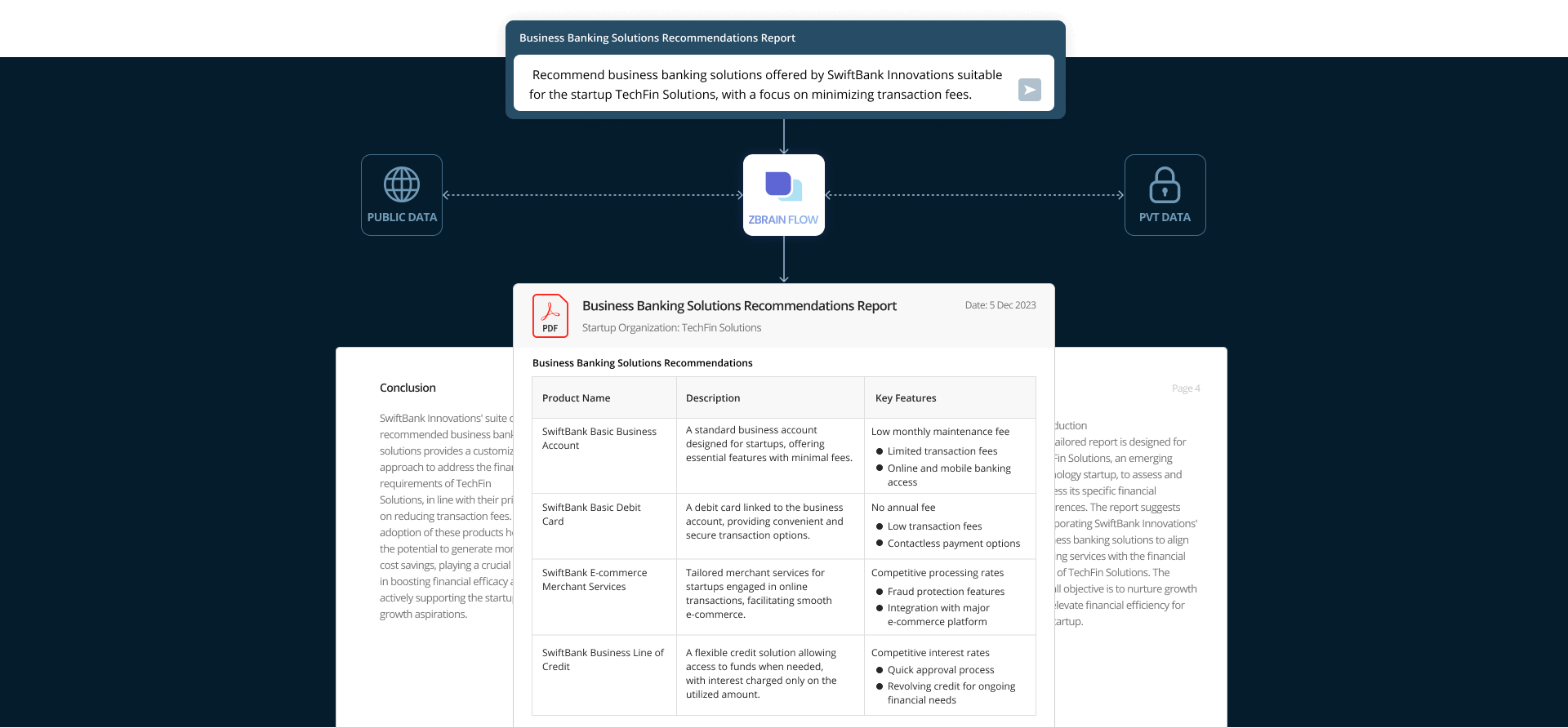

III. ZBrain Flow: How It Works?

Step 1: Data Collection and Integration

In its initial phase, ZBrain automates the collection of diverse data sources critical for informed product recommendations, including customer transaction history, behavior analytics, market trends, and product performance metrics. The collected data is seamlessly integrated into a centralized database, forming the foundation for the product recommendation model.

Step 2: Exploratory Data Analysis (EDA) for Data Understanding

Before diving into the product recommendation process, ZBrain conducts an automated EDA on the collected data. This step involves uncovering underlying structures and identifying missing values, outliers, correlations, and patterns that could impact the recommendation accuracy. Insights gained from EDA ensure that the data used is highly relevant for personalized recommendations.

Step 3: Embedding Generation

In this phase, the data, refined through the EDA process, undergoes transformation into numerical representations using advanced techniques. Through these embeddings, ZBrain analyzes relationships and patterns within the data, laying the groundwork for meaningful insights during the product recommendation process.

Step 4: Query Execution and Product Recommendation

When a user submits a query seeking personalized product suggestions, ZBrain retrieves pertinent data aligned with the user’s query requirements. This gathered data and the specific query are then transferred to the OpenAI Language Model (LLM) to generate tailored product recommendations.

Using the acquired embeddings, the OpenAI LLM deeply understands and contextualizes the intricate details within the data. This involves thoroughly analyzing customer transaction history, preferences, and relevant financial market trends. Drawing insights from the dataset, user query specifics, and the desired structure for the recommendation, the OpenAI LLM dynamically crafts a detailed and coherent set of product recommendations. The result is a personalized and insightful report that aligns precisely with the user’s preferences and the overall objectives of the financial institution.

Step 5: Final Output Generation

Following the report generation, ZBrain initiates data parsing to filter out irrelevant information, ensuring the recommendations are accurate and focused. The parsed data is thoughtfully structured, aligning precisely with the desired format, sections, and recommendation guidelines.

Personalized Product Recommendations

With an automated, AI-powered process, ZBrain remarkably reduces the time and effort required for generating personalized product recommendations. The traditional process, which typically took approximately 32 hours, is now streamlined to just around 3 hours, leading to notable time and cost savings. This enhanced efficiency empowers financial institutions to deliver more timely and precise product recommendations, ultimately elevating customer satisfaction and fostering greater loyalty. Embrace ZBrain for a transformative approach to decision-making, where efficiency meets personalization, redefining how financial institutions engage and serve customers.

Prompt:

Recommend business banking solutions offered by SwiftBank Innovations suitable for the startup TechFin Solutions, with a focus on minimizing transaction fees.

Introduction

This tailored report is designed for TechFin Solutions, an emerging technology startup, to assess and address its specific financial preferences. The report suggests incorporating SwiftBank Innovations’ business banking solutions to align banking services with the financial goals of TechFin Solutions. The overall objective is to nurture growth and elevate financial efficiency for the startup.

Client Profile

-

Company Name: TechFin Solutions

-

Industry: Technology

-

Startup Age: 1 year

-

Annual Revenue: $500,000

-

Location: Silicon Valley, USA

Financial Goals and Preferences

TechFin Solutions, a technology startup, is committed to enhancing financial operations, with a particular emphasis on reducing transaction costs. With a focus on promoting sustainable growth, the company seeks business banking solutions that align with its financial objectives, providing cost-effective transaction options.

Current Financial Snapshot

-

Average Monthly Transactions: 100

-

Monthly Revenue: $40,000

-

Current Business Account Provider: SwiftBank Innovations

Business Banking Solutions Recommendations

| Product Name | Description | Key Features |

|---|---|---|

| SwiftBank Basic Business Account | A standard business account designed for startups, offering essential features with minimal fees. | – Low monthly maintenance fee

– Limited transaction fees – Online and mobile banking access |

| SwiftBank Business Debit Card | A debit card linked to the business account, providing convenient and secure transaction options. | – No annual fee

– Low transaction fees – Contactless payment options |

| SwiftBank E-commerce Merchant Services | Tailored merchant services for startups engaged in online transactions, facilitating smooth e-commerce. | – Competitive processing rates

– Fraud protection features – Integration with major e-commerce platforms |

| SwiftBank Business Line of Credit | A flexible credit solution allowing access to funds when needed, with interest charged only on the utilized amount. | – Competitive interest rates

– Quick approval process – Revolving credit for ongoing financial needs |

Recommendation Rationale

Considering TechFin Solutions’ priority on minimizing transaction fees, the SwiftBank Basic Business Account is recommended for its simplicity and cost-effectiveness. The associated Business Debit Card ensures secure and convenient transactions, aligning seamlessly with the startup’s operational needs. The E-commerce Merchant Services offer competitive rates and robust fraud protection for online transactions. The Business Line of Credit also provides financial flexibility without incurring excessive costs.

Projected Cost Savings

| Product | Estimated Monthly Cost Savings |

|---|---|

| SwiftBank Basic Business Account | $50 (compared to the current account) |

| SwiftBank E-commerce Merchant Services | $30 (based on competitive processing rates) |

| Total Projected Monthly Savings | $80 |

Conclusion

SwiftBank Innovations’ suite of recommended business banking solutions provides a customized approach to address the financial requirements of TechFin Solutions, in line with their priority on reducing transaction fees. The adoption of these products holds the potential to generate monthly cost savings, playing a crucial role in boosting financial efficacy and actively supporting the startup’s growth aspirations.