Real Estate

AI-driven Insights for Optimal Property Market Analysis and Investment Success

Inefficiencies in Data Handling and Resource Drain

A detailed market analysis is paramount in making well-informed decisions in the real estate landscape. Traditional methods, while proven effective, often face challenges in efficiently collecting and interpreting vast data, resulting in a drain on valuable time and resources. The reliance on spreadsheets and manual documentation can slow down the analysis process, making it susceptible to errors and delays. Additionally, traditional methods may struggle to keep pace with the rapidly evolving market dynamics, hindering the ability to extract timely insights. ZBrain streamlines the evaluation of market trends and property values, providing a comprehensive solution for the intricate demands of the real estate industry.

I. How ZBrain Enhances Property Market Analysis

ZBrain employs artificial intelligence and machine learning to automate traditionally manual processes involved in property market analysis. The following table compares the time required for each analysis task with and without the use of ZBrain Flow:

| Steps | Without ZBrain Flow | Time Without ZBrain Flow | With ZBrain Flow |

|---|---|---|---|

| Data acquisition | Manual | ~8 hours | Automated by ZBrain Flow |

| Data cleaning and preparation | Manual | ~5 hours | Automated by ZBrain Flow |

| Query execution and property market analysis | Manual | ~8 hours | Automated by ZBrain Flow |

| Report generation | Manual | ~6 hours | Automated by ZBrain Flow |

| Report review and finalization | Manual | ~4 hours | Manual |

| Total | ~31 hours | ~3 hours |

As demonstrated in the table, ZBrain significantly reduces the time spent on property market analysis from approximately 31 hours to around 3 hours, resulting in substantial time and cost savings.

II. Essential Input Data

For optimal performance and accurate output, ZBrain necessitates the following data sources:

| Information Source | Description | Recency |

|---|---|---|

| Internal records | Detailed information on property types, locations, and quantities. | Always updated |

| Financial statements | Revenue, expenses, and financial health indicators | Last fiscal year |

| Lease agreements | Occupancy rates, lease terms, and tenant information | Real-time |

| External factors | Information on market trends, seasonal fluctuations, economic indicators, competition, etc. | Last fiscal year |

| Sales history | Historical property sales data, movements, and patterns | Always updated |

| Neighborhood data | Proximity to amenities, market trends, and historical performance | Real-time |

III. ZBrain Flow: How It Works?

Step 1: Data Collection and Exploratory Data Analysis (EDA)

The initial phase of an efficient property market analysis involves meticulous data gathering, a vital task expertly managed by ZBrain. ZBrain automatically retrieves pertinent data from diverse sources, including property details, historical performance, market trends, regulatory compliance, financial metrics, and regional indicators.

Once the data is compiled, ZBrain initiates an automated EDA on the gathered data to reveal insightful patterns. EDA unveils data structures, detecting missing values, outliers, and correlations and identifying patterns that shape property market evaluations.

Step 2: Embedding Generation

In this stage, textual data related to property profiles, market trends, and compliance records transform into numerical representations using advanced embedding techniques like word embeddings or sentence embeddings. These embeddings capture semantic meanings and relationships, enabling streamlined retrieval and effective analysis.

Step 3: Query Execution and Report Generation

Upon receiving a user query for a property market analysis report, ZBrain retrieves relevant data based on query requirements. This data and the user’s query are fed into the OpenAI Language Model (LLM) for report generation.

Utilizing acquired embeddings, the OpenAI LLM deeply comprehends and carefully analyzes the provided data, exploring its intricate nuances. Pulling insights from the dataset, query specifics, and the planned report structure, the OpenAI LLM dynamically generates a detailed and readable report text.

Step 4: Parsing the Generated Report

A parsing process is initiated once the property market analysis report is generated in text format. This process expertly extracts essential information, including property assessments, trends, rankings, and conclusions. The parsed data is then thoughtfully structured to ensure the final report aligns precisely with the desired format, sections, and reporting guidelines. ZBrain includes necessary headers, formatting, and references to create a detailed property market analysis report. This organized approach guarantees that the report is driven by data and presented in a professional and easily understandable manner.

Enhanced Property Investment Decision-making

ZBrain sets a new standard for property market analysis, providing a swift and efficient process that equips real estate professionals with the insights needed for well-informed investment decisions. With a remarkable reduction in analysis time, slashing it from approximately 31 hours to around 3 hours, stakeholders gain the agility to respond promptly to market changes, identify lucrative opportunities, and optimize their property portfolios for maximum returns. Utilize the strength of ZBrain to navigate the intricate landscape of the real estate market with precision and confidence.

Prompt:

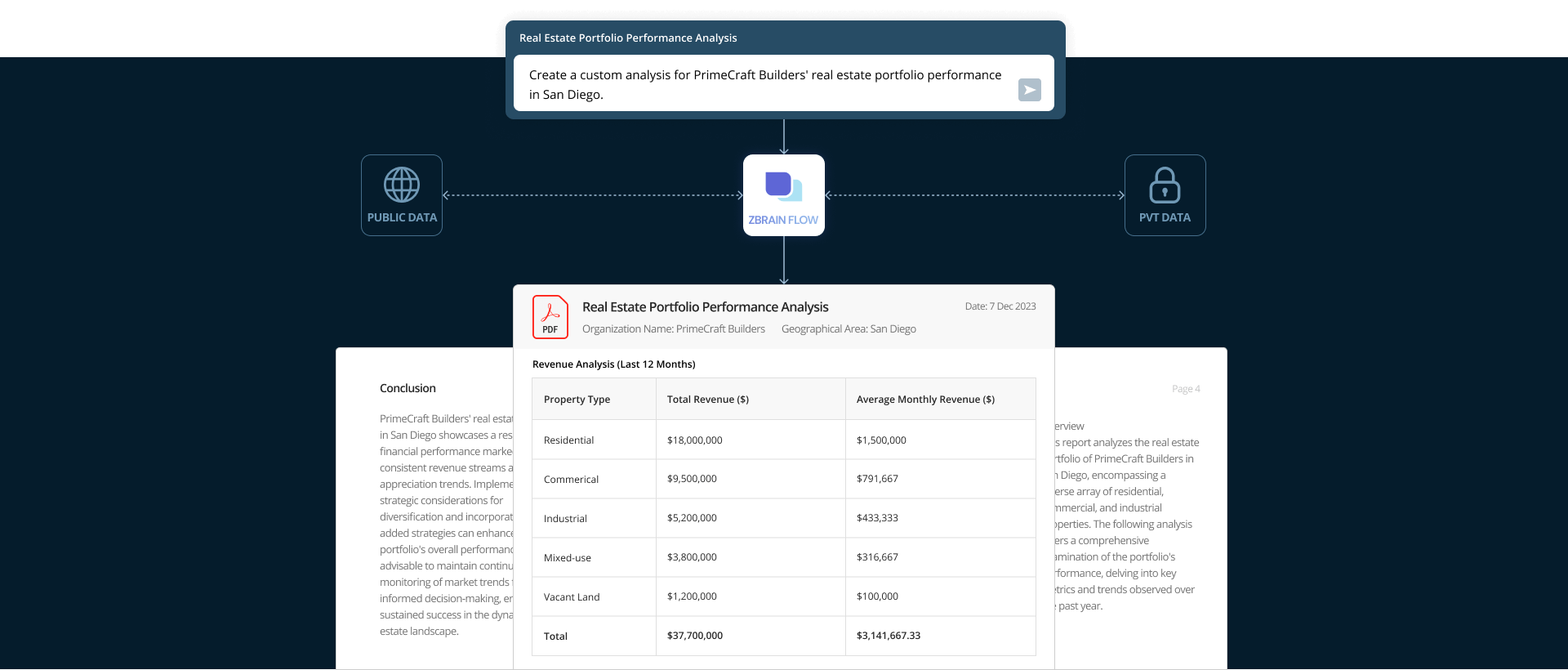

Create a custom analysis for PrimeCraft Builders’ real estate portfolio performance in San Diego.

Overview

This report analyzes the real estate portfolio of PrimeCraft Builders in San Diego, encompassing a diverse array of residential, commercial, and industrial properties. The following analysis offers a comprehensive examination of the portfolio’s performance, delving into key metrics and trends observed over the past year.

Methodology

To ensure a thorough and accurate assessment of PrimeCraft Builders real estate portfolio, the following methodology was employed:

- Data Collection:

-

Property information, including type, location, and financial data, was gathered from PrimeCraft Builders’ internal records.

-

External sources, such as local property databases, were utilized to supplement and verify property details.

- Geographic Distribution Analysis:

-

This analysis considered factors such as proximity to amenities, market trends, and historical performance in each neighborhood.

- Financial Performance Evaluation:

-

Revenue data for the last 12 months was extracted from financial records.

-

Occupancy rates were derived from property management systems and lease agreements.

- Market Trends Assessment:

-

Historical price appreciation rates were calculated based on property sale data over the last five years.

-

Sales velocity was determined by analyzing the number of properties sold in the past year.

Property Types in Portfolio

| Property Type | Number of Properties |

|---|---|

| Residential | 20 |

| Commercial | 10 |

| Industrial | 5 |

| Mixed-use | 3 |

| Vacant Land | 2 |

| Total | 40 |

Geographic Distribution

The properties are distributed across various neighborhoods in San Diego:

| Neighborhood | Number of Properties |

|---|---|

| Downtown | 8 |

| La Jolla | 6 |

| North Park | 5 |

| Mission Valley | 7 |

| Sorrento Valley | 4 |

| Kearny Mesa | 10 |

| Total | 40 |

Financial Performance

1. Revenue Analysis (Last 12 Months)

| Property Type | Total Revenue ($) | Average Monthly Revenue ($) |

|---|---|---|

| Residential | $18,000,000 | $1,500,000 |

| Commercial | $9,500,000 | $791,667 |

| Industrial | $5,200,000 | $433,333 |

| Mixed-use | $3,800,000 | $316,667 |

| Vacant Land | $1,200,000 | $100,000 |

| Total | $37,700,000 | $3,141,667.33 |

2. Occupancy Rates

| Property Type | Average Occupancy Rate (%) |

|---|---|

| Residential | 95 |

| Commercial | 90 |

| Industrial | 80 |

| Mixed-use | 85 |

| Overall | 88.75 |

Market Trends

1. Price Appreciation

| Property Type | Average Annual Appreciation Rate (%) |

|---|---|

| Residential | 7 |

| Commercial | 5 |

| Industrial | 4 |

| Mixed-use | 6 |

2. Sales Velocity

| Property Type | Number of Properties Sold |

|---|---|

| Residential | 15 |

| Commercial | 8 |

| Industrial | 4 |

| Mixed-use | 3 |

| Total | 30 |

Recommendations

- Diversification: To mitigate risk and explore emerging market opportunities, consider diversifying the portfolio.

- Value-add Strategies: Explore value-add strategies for underperforming properties to enhance overall portfolio returns.

- Market Expansion: Evaluate the potential for expanding into high-growth neighborhoods based on market trends and price appreciation.

- Optimize Commercial Assets: Implement measures to optimize commercial property occupancy rates for increased revenue.

Conclusion

PrimeCraft Builders’ real estate portfolio in San Diego showcases a resilient financial performance marked by consistent revenue streams and positive appreciation trends. Implementing strategic considerations for diversification and incorporating value-added strategies can enhance the portfolio’s overall performance. It is advisable to maintain continuous monitoring of market trends for informed decision-making, ensuring sustained success in the dynamic real estate landscape.