A deeper look into liquidity pools and how they are vital to the DeFi ecosystem

Listen to the article

Imagine there is not enough liquidity in the market. What will happen? The time to convert an asset into cash will significantly rise. When adequate liquidity is in the market, converting assets into cash is much quicker and easier, preventing sudden price fluctuations. In fact, the success of both traditional and decentralized finance sectors relies heavily upon adequate liquidity.

With the rise of decentralized finance (DeFi) and the continuous development of blockchain technology, liquidity pools have become one of the most talked about trends in the crypto space. With the promise of automated, trustless markets, liquidity pools are a promising way to take advantage of the decentralized finance revolution and make use of digital assets for financial gain. This article will explore the ins and outs of liquidity pools and how they could potentially revolutionize the way people invest in digital assets.

- What is a liquidity pool?

- How do liquidity pools work?

- Significance of liquidity pools in DeFi

- Advantages of liquidity pools

- Why are liquidity pools important?

- Some important use cases of liquidity pools

- Top liquidity pools

What is a liquidity pool?

A liquidity pool is a group of digital assets gathered to facilitate automated and permissionless trading on a decentralized exchange platform. The users of such exchange platforms don’t rely on a third party to hold funds but transact with each other directly.

Unlike a centralized exchange, DEX requires more liquidity as it uses automated market makers (AMM). AMM is essentially the major component of liquidity pools. They are mathematical functions used to determine prices based on supply and demand. This pool is an integral part of the decentralized exchange ecosystem as it provides the liquidity necessary for such platforms to function.

Digital cryptocurrencies in liquidity pools are locked in smart contracts. Liquidity pools are a modern method of increasing liquidity in the crypto market, and they work just like market makers in traditional exchanges.

How do liquidity pools work?

Liquidity pools are designed to offer traders an opportunity to swap between assets on decentralized exchanges. These pools are created by a group of smart contracts operated using a treasury. The treasury is funded by individuals known as “Stakers” who contribute equal amounts of two different tokens, one volatile asset and another a stable asset, to the protocol.

After stakers crowdfund liquidity pools, the pool waits for the traders willing to buy and sell the two assets. When a trader wants to swap between two assets, the protocol allows them to do so in exchange for a small transaction fee. The fees are charged to provide liquidity and convenience to the user of the decentralized exchange.

In exchange for two different tokens, the depositor receives LP tokens (Liquidity Pool), representing their share of the pool. The number of LP tokens a staker receives is calculated based on the ratio: Amount deposited from the staker (USD) divided by the total value of the pool (USD) equal to LP tokens received (USD) divided by the total circulating supply of LP tokens (USD).

Significance of liquidity pools in DeFi

Liquidity pools play an integral role in the decentralized finance ecosystem, especially in decentralized exchanges. These pools provide much-needed liquidity, speed, and convenience to the DeFi space. Crypto liquidity pools basically allow users to pool their assets in DEXs’ smart contracts and provide asset liquidity for traders to swap between currencies.

Earlier, when AMM was not introduced, the liquidity of the crypto market was a major challenge for DEX. The decentralized exchange was new, having a complicated interface to understand. However, buyers and sellers were also fewer in number. Consequently, it became difficult to trade assets regularly.

Furthermore, cash is considered the most liquid asset in traditional finance because it is easily converted to other assets such as gold, stocks, and bonds. However, it cannot be easily converted to cryptocurrency. Bitcoin is currently the most liquid asset in the broader crypto space, as it is widely accepted and tradeable on centralized exchanges.

Within the decentralized finance (DeFi) ecosystem, which is built largely on the Ethereum network, Ether is the most liquid asset because it is the native asset of Ethereum and is accepted and tradeable on decentralized exchanges (DEXs). Now that AMM has created liquidity pools, the problem of limited liquidity has been solved. These pools offer liquidity providers the incentive to supply pools with assets. A pool with more assets and more liquidity makes trading on decentralized exchange easier.

Also, in DeFi, LP tokens allow the creation of smoothly convertible assets that can be used multiple times, even if they are invested in a DeFi product or staked in a platform governance mechanism. This is because LP tokens enable an indirect form of staking in which you prove ownership of tokens rather than staking the tokens themselves. This helps to alleviate the problem of locked crypto liquidity.

Advantages of liquidity pools

There are various benefits of these crypto liquidity pools suggesting that they will continue to be a significant part of the DeFi landscape.

Here are some of the advantages:

- A liquidity pool ensures that decentralized exchanges and lending platforms have the sufficient liquidity they need for their smooth operation.

- Liquidity pools help market makers contribute to a pool’s liquidity who may not be able to otherwise.

- Liquidity providers can earn multiple streams of income by deploying their tokens on various DeFi protocols.

- Liquidity providers can participate in the decision-making process of a protocol by earning governance tokens and voting with them.

- Liquidity pools allow traders to transact without fear of losing their money due to liquidity in the market.

- Anyone can access liquidity pools, making them a democratic and decentralized financial tool.

Why are liquidity pools important?

Earlier, most traditional finance instruments, such as stock exchanges, were based on the order book model. This model involves two-party participation. One is the buyer, and another is the seller. The transactions are further processed only when the buyers and sellers agree on a certain asset price. Although smooth, this model didn’t seem to go well with the crypto space.

The DeFi market, during its initial stage, could not benefit from the level of liquidity supplied by the traditional makers. However, trading in markets with low liquidity is risky due to slippage (the difference between the expected price of the trade and the actual price at which it is executed). This happens during times of high volatility or when there is not enough activity in the market to maintain a consistent bid-ask spread. The bid-ask spread is the difference between the price sellers are willing to sell an asset and buyers are willing to pay for it. The spread may be wider in markets with low liquidity, resulting in larger slippage and the executed trade price potentially exceeding the original market order price.

The introduction of liquidity pools was a game-changer for the entire decentralized finance market. These pools seek to address the issue by incentivizing users to provide liquidity in exchange for a share of the trading fees. Further, the reason why crypto liquidity pools have gained traction is because of their decentralized nature. No centralized authority is involved in facilitating trades, as liquidity is locked inside a smart contract. This helped cut out unnecessary third parties and allowed traders to conduct peer-to-peer transactions. For instance, some pools, such as Uniswap and Bancor, allow users to easily exchange tokens and assets using smart contracts without the need for a matching buyer or seller.

Some important use cases of liquidity pools

Liquidity pools have become a popular tool for decentralized exchange to provide traders with access to a wide range of assets. The feature offered by these pools has led to their best use cases to exist. This section will explore some key use cases of crypto liquidity pools.

Liquidity mining

Liquidity mining is a strategy that involves contributing funds to liquidity pools on automated yield-generating platforms such as yearn in order to generate income. It is a popular method for getting more tokens into the hands of the right people and has shown to be a highly profitable strategy. When users deposit their tokens into a liquidity pool, they receive tokens according to an algorithm, which can then be assigned to other pools or protocols.

Governance

Liquidity pools can also be used for governance. In some cases, a large number of token votes may be needed to propose a governance plan. However, if participants pool their resources together, they can support a common cause that they believe is important for the protocol.

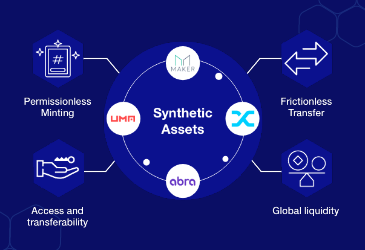

Minting synthetic assets

Liquidity pools are also used in the creation of synthetic assets on the blockchain. The creation process involves the addition of collateral into the liquidity pool and connecting it to a trusted oracle. This results in the formation of a synthetic token that is pegged to the asset of your choice.

Tranching

The concept of tranching comes from traditional finance. Tranching refers to using liquidity pools that divide financial products based on their risks and returns. These products allow liquidity providers (LPs) to customize their own risk and return profiles.

Insurance

Insurance against smart contract risk is another emerging area in the DeFi market. Many of the applications in this sector are powered by liquidity pools.

Top liquidity pools

Decentralized platforms often utilize liquidity pools and AMM to allow automated and permissionless digital asset trading. In fact, some platforms are specially designed to center their operations around liquidity pools. They are:

Uniswap

Uniswap is a decentralized open-source exchange for ERC-20 tokens that allow for trading Ethereum contracts and ERC-20 token contracts in a 1:1 ratio. The high trading volume makes Uniswap special and a well-known and highly regarded platform for liquidity pools. Anyone can launch new liquidity pools for any token without incurring fees. The platform charges a competitive exchanging fee of 0.3%, and liquidity providers receive a share of these fees based on their share in the pool.

Curve Finance

As one of the best-decentralized liquidity pools based on Ethereum, the Curve offers favorable trading opportunities for stablecoins. Curve finance guarantees reduced slippage with non-volatile stablecoins. However, it does not have a native token, but the introduction of CRV tokens is expected in the near future. Further, Curve offers seven different pools for swapping various crypto assets and stablecoins, such as Compound, PAX, BUSD, and others.

Balancer

Balancer is an Ethereum-based liquidity pool that serves as a non-custodial portfolio manager and price sensor. Using Balancer, users enjoy the flexibility of customizing pools as well as earning trading fees by subtracting and adding liquidity. The modular pooling protocol of Balancer allows it to support multiple pooling options, such as private, smart, or shared pools. In march 2020, the pool distributed BAL governance tokens in order to introduce a liquidity mining facility.

Bancor

Bancor is based on Ethereum and uses algorithmic market-making methods with smart tokens. The platform offers liquidity and accurate pricing. A constant ratio between different tokens connected together is maintained while implementing modifications in the supply of tokens. Bancor’s Relay liquidity pool has also introduced a Bancor stablecoin to resolve the volatility in liquidity issues. It supports liquidity pools with BNT tokens, ETH or EOS tokens and the USDB stablecoin. Bancor is considered one of the top liquidity pools because of its ability to employ BNT for simple data transfer between various blockchain networks. Instead of a fixed exchange fee, Bancor chargers charge a percentage of the transaction, ranging from 0.1% to 0.5%, depending on the pool.

KeeperDAO

KeeperDAO is an Ethereum-based DeFi protocol that offers financial incentives for participants and manages effective liquidation. It also rebalances applications across margin trading, exchanges, and lending protocols. Further, deposits in KeeperDAO liquidity pools incur a 0.64% fee deduced from the asset provided in the pool. Five different liquidity pools are available for farming ROOK tokens. Keeper of KeeperDAO and JITU use the liquidity from these pools to facilitate flash loans.

Endnote

As the popularity and the demand for liquidity pools rise exponentially, the future for cryptocurrency and DeFi markets seem promising. Among other things, by using these pools, crypto transactions no longer need to wait for matching orders and can be programmed through contracts. Liquidity pools also open the DeFi space for additional consumers and resolve the issues related to crypto market liquidity. In addition, the pools provide new potential for new traders entering the DeFi market and help them overcome trust concerns while trading. With smart contracts, decentralized trading, lending, and yield generation, these pools will likely power the crypto market and become the core technologies behind the DeFi technology stack.

If you want professional development services for DeFi platforms, LeewayHertz is the ideal choice. Our expert developers are proficient in creating a wide range of DeFi solutions, such as swap and exchange platforms.

Listen to the article

Start a conversation by filling the form

All information will be kept confidential.

Insights

DeFi asset tokenization: Unlocking new possibilities

DeFi asset tokenization is the next step in the evolution of securitization, made possible by blockchain technology.

Wrapped tokens: An innovative approach to interoperability

Learn how wrapped tokens play a critical role in enabling cross-chain interoperability and in providing new financial services within the blockchain ecosystem.

What are synthetic assets in decentralized finance

Crypto synthetic assets are gaining popularity in the crypto world as they allow investors to benefit from token fluctuations without actually owning them.